Why UPI isn’t actually free?

The exponential growth of India’s digital payment system is driven by incentives. But those incentives are now shifting and even being called into question.

“The important thing is that the UPI, or any other payment system for that matter, is accessible, cheap, secure, and sustainable…and it will be sustainable only if someone bears the costs. So as long as it’s the government or someone else — that’s not so important — the important thing is that costs of any service should be paid, whether collectively or by the user.”

That’s the RBI Governor Sanjay Malhotra talking about India’s vaunted Unified Payments Interface (UPI) in July 2025.

And in a nutshell, what he’s saying is that “there’s no free lunch”.

Someone, somewhere is footing the bill for the free UPI we all enjoy.

Free UPI? But isn’t it simply an alternative to cash, you ask?

Okay, well, think about what happens when you swipe your credit or debit card at the kirana store. There’s something powering the debit of money from your account and the credit to the store owner, right? That something is a supremely powerful payment rail operated by card companies like Mastercard and Visa, the banking system and a whole lot of other intermediaries. That’s what powers the instantaneous flow of information across all the parties who’re involved.

And it’s business at the end of the day. So the folks powering it impose a fee on the kirana store for availing the payment services. It’s called the Merchant Discount Rate (MDR).

That means, if you swipe your card for ₹1,000 at the store, the kirana shop owner won’t get the entire amount. They’ll only get around ₹975-Rs 980. Roughly The rest of it gets split among the intermediaries.

Now here is the thing. What do you think happens when you scan that QR code and hit pay? It might seem like child’s play but there’s layers of financial plumbing and infrastructure that involve your bank checking if you have the money and then sending the communication to the receiver’s bank to credit their account here too. It’s near perfect synchronization.

But unlike in the case of card payments, your kirana store gets the entire amount you’ve sent them. Not a paisa less.

And that’s because there’s no MDR that hurts UPI. Yup, it used to be in place at one point in the distant past, but not anymore. The government got rid of it in early 2020.

The government wanted a cashless economy. And they knew that to get people to ditch their beloved cash, they had to make digital payments irresistibly convenient and more importantly, free. So UPI became the primary weapon in its arsenal. I mean, a QR code, a smartphone, and the internet. That’s all it took for UPI to catapult us into the golden age of ‘send money, pay nothing’

Now it might be a good idea to pause here and appreciate what UPI has achieved because this little payment system has turned into a digital payments giant. We're talking about processing over 600 million transactions in a single day and monthly transactions worth ₹25 lakh crore. To put that in perspective, that's 3x the GDP of a small country like Luxembourg flowing through UPI every month. From your tender coconut seller on the corner to the high-end fashion store in the mall, everyone’s got a QR displayed in plain sight.

But there’s a hiccup in this happy tale. The “no free lunch” principle exists.

Running UPI isn’t exactly cheap. We're talking about a massive, 24/7 operation that handles what could very soon be nearly a billion transactions daily. And to keep this running, there is constant maintenance, security upgrades, fraud prevention, customer support, and enough server power to handle more traffic than the Mumbai local trains during rush hour.

So while users have been happily making free transactions, someone has been quietly paying the bills. The organizations running this show — primarily banks and payment service providers — have been burning through cash.

Oh yeah, the UPI isn’t exactly owned by the government. It’s run by this entity called the National Payments Corporation of India (NPCI) which is a group of commercial banks who banded together initially for this task. These folks were in charge of putting together the tech rails for UPI.

And in 2022, the Reserve Bank of India (RBI) did the math and said that when someone makes a UPI payment to a merchant, the stakeholders — banks, NPCI, and payment providers — have to bear a cost that's 0.25% of the transaction value. So on a ₹1,000 transaction, it would be a cost of ₹2.5.

Seems puny, right?

But, when you put that into the overall scheme of ₹7 lakh crore worth of monthly peer-to-merchant (P2M) transactions (the ₹25 lakh crore we mentioned earlier also includes the money you sent your friend for splitting the bill from your last night out), it adds up quickly.

In fact, if you go by the RBI’s own estimate and do a back of the envelope extrapolation, it means that stakeholders probably incurred a cost of somewhere around ₹20,000 crores in FY25. That's the money spent on all the boring-but-essential tech and compliance stuff that keeps your money moving safely.

(We could be wrong about that number but PwC’s similar calculation pegged the figure at ₹12,000 crores in FY24. So it’s just a rough estimate)

Now sure, the government is a generous sponsor of this digital revolution. It was in their interest after all that MDR was abolished. So they do provide subsidies* to banks and payment providers to keep UPI free for everyone.

But the subsidy money is dwindling. As the Indian Express reports — from over ₹3,250 crores in FY24 to ₹2,000 crores in FY25 and just over ₹400 crores being reportedly set aside for FY26.

That’s nowhere near enough to cover the rising operational costs.

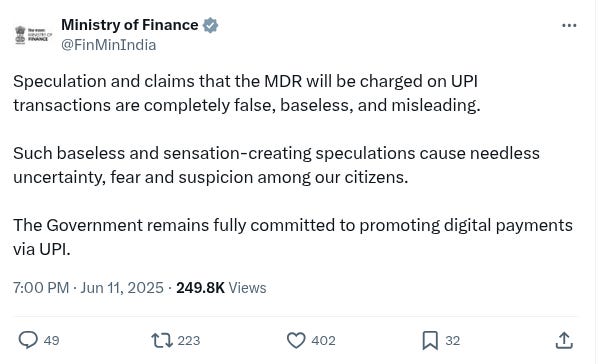

So the government simply tweeting that the UPI is a ‘public good’ and that there will be no MDR might not cut it for the ecosystem anymore.

And it’s no wonder the industry is getting restless

Banks and fintech companies have started making noise saying "we can't keep doing this for free forever." In March 2025, folks at the Payments Council of India (made up of around 180 fintechs and payment firms) also implored the country’s Prime Minister to introduce a fee for UPI transactions.

More lately, ICICI Bank has mentioned that the bank will levy a fee of ₹0.02-0.04 (subject to some caps) per ₹100 per UPI transaction on certain payment intermediaries in the chain. This starts in August.

And you’d have to imagine that somewhere these folks who’re being charged will also have to pass the costs along.

How, we don’t know yet. But going back to what the RBI Governor said, “the important thing is that costs of any service should be paid, whether collectively or by the user.”

At the moment, it’s the payment intermediaries who are bearing the cost of UPI. Soon it could be the merchants just like with MDR on cards. Or maybe it’ll end up being us users.

Either way, UPI wasn’t, isn’t, and will not be a free lunch. Technically.

*The government subsidies are meant to compensate for P2M UPI transactions below ₹2000. And in value terms, nearly 70% of this category is above this threshold. Also, you could also argue that government subsidies are taxpayer money anyway. So the users have been footing this bill for a while now.

This newsletter is written by Nithin Sasikumar.

Do read ITR: ‘What’s the point of dividend-yield mutual funds?’ in our newsletter, ‘Second Order’ by Zerodha Varsity.

For any feedback or topic suggestions, write to us at varsity@zerodha.com

Great stuff!

DEAR TELL ME BY ZERODHA VARSITY,many thanks for not just telling me but convincing me Why UPI is actually not free.