What’s the point of dividend-yield mutual funds?

One myth and 3 observations about dividend-yield funds

Let me tell you one myth and three observations about dividend yield mutual funds in India.

Dividends have a universal appeal. Whenever you receive them, they feel like extra income we earned without much effort.

Not only are retirees looking for a regular paycheck, but even those who want to have some passive income are drawn to dividends.

And if you expect to get regular dividends just because you invest in a dividend-yield mutual fund in India, that's not how they work.

The common confusion is that these funds are designed to give you a steady income, or that by investing in high dividend-paying companies, they somehow pass bigger dividends to you.

The truth is, these funds are just like any other mutual fund category, such as large-cap, mid-cap, or value funds.

The only difference is that they focus on companies known for consistently paying dividends.

When a dividend yield fund receives payouts from these companies, they don't automatically go to your pocket (unless you've chosen a payout option). The fund takes them and reinvests.

So the name ‘dividend-yield’ fund comes from what they invest in — high-dividend-paying companies — not because the fund itself is going to give you income.

And that's busting the myth about dividend yield funds in India.

Observation -1

Now, if these funds aren’t about giving you regular income, what’s their real purpose?

It comes down to the kind of companies they hold. Dividend-yielding companies are usually mature, with steady cash flows.

Take ITC, for example. It's not a startup trying to grow rapidly by reinvesting every rupee back into the business. It’s an established company that generates more cash than it needs to run operations or build capacities. So, it shares some of that excess cash with shareholders as dividends.

Compare this to a young tech company that's still expanding. They'd rather use every rupee to hire more people, build new products, or enter new markets. Paying dividends would mean less money for growth.

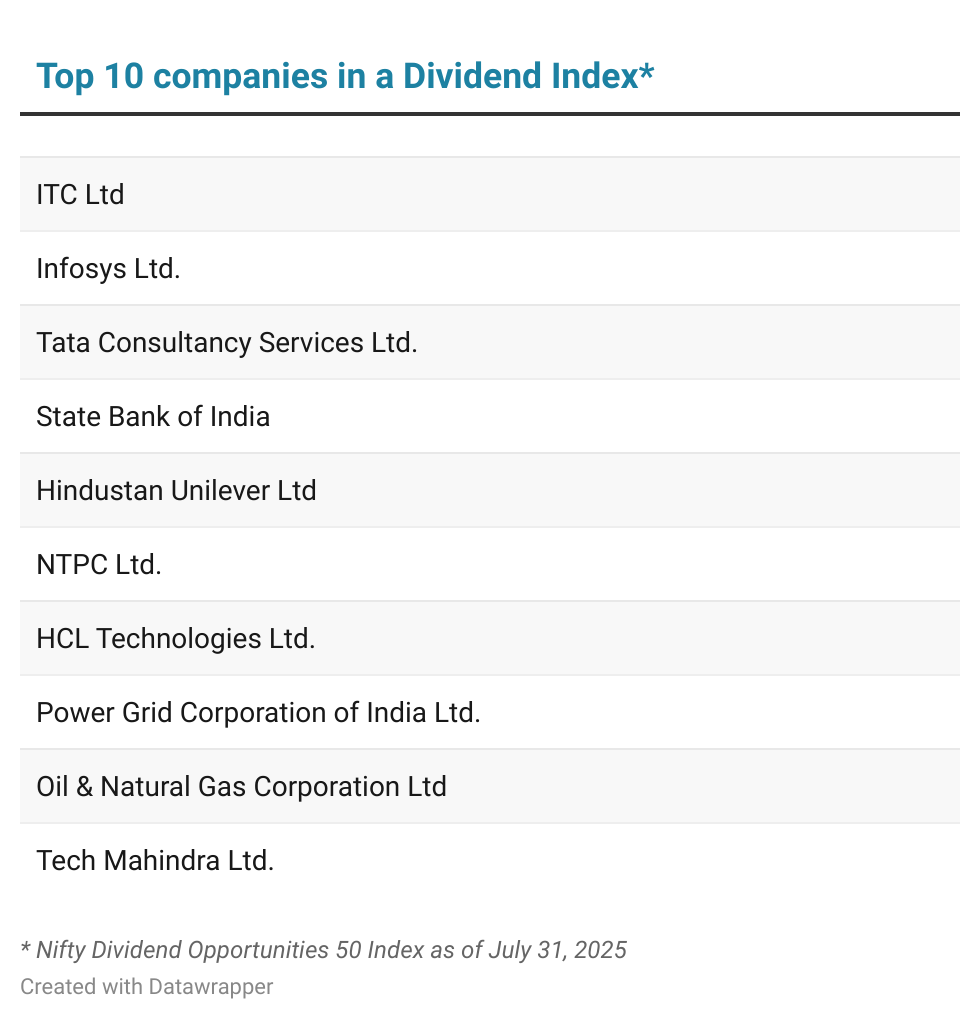

By the way, when you search for high dividend-yield companies in India, you will notice many PSUs (public sector undertakings like NTPC and ONGC) as well. The government is the shareholder here and receives huge cash flows when these companies announce dividends.

Dividend-paying companies, because of their characteristics, are generally seen as stable and less volatile compared to others. That means, theoretically, they are expected to fall less when markets correct.

This is also one of the key selling points of dividend-yield mutual funds in India. Let’s see if they lived up to the word in the past.

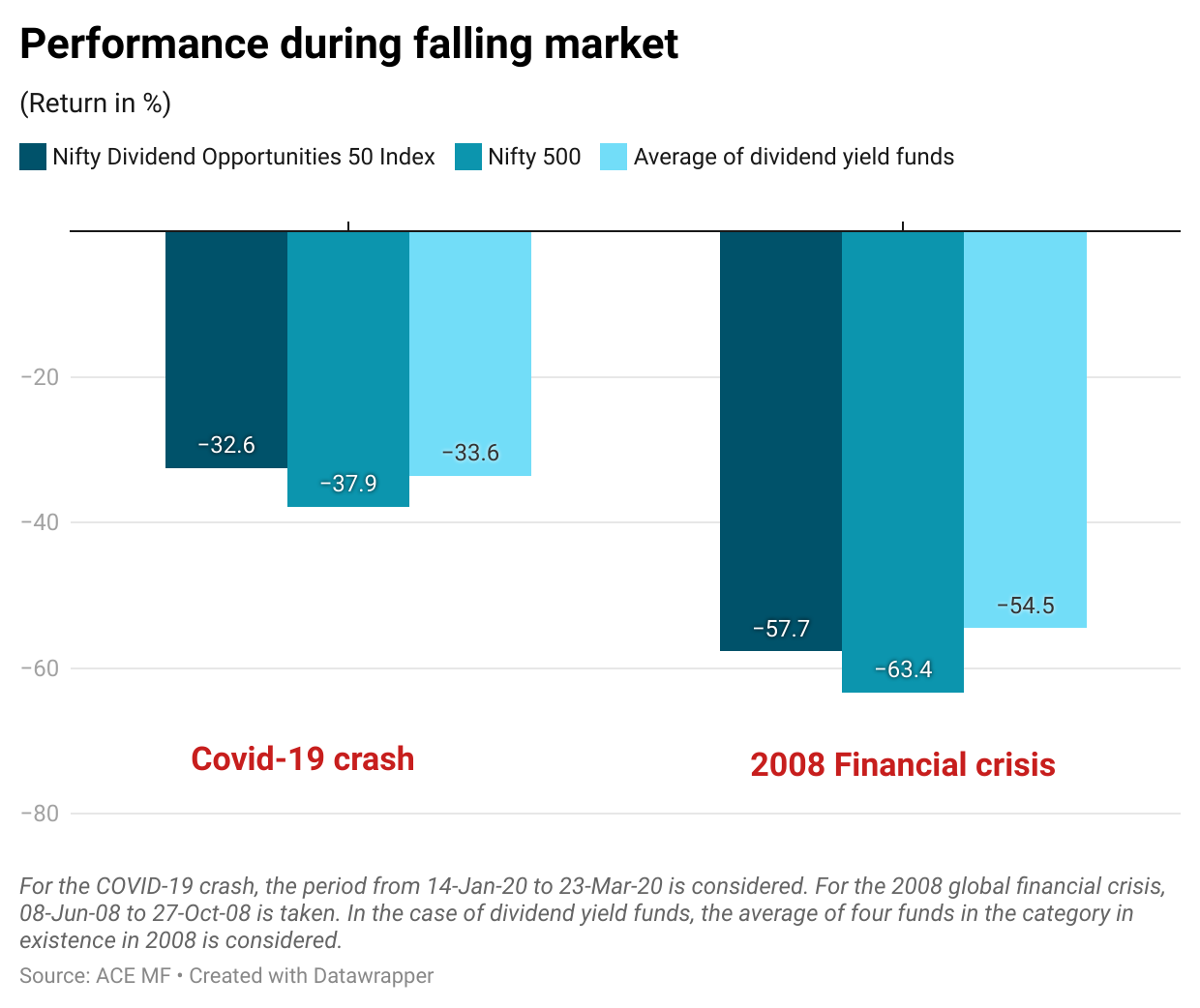

To show this, we have compared a dividend index (Nifty Dividend Opportunities 50), which has a mix of 50 high dividend-paying companies in India, with a broader diversified index (Nifty 500), which has the top 500 companies across sectors.

In India, we have seen two notable crashes—one in 2008 due to the global financial crisis and another in 2020 due to the COVID-19 outbreak. During these two periods, the dividend index has fallen less than the broader market index (see image above). That's our first observation.

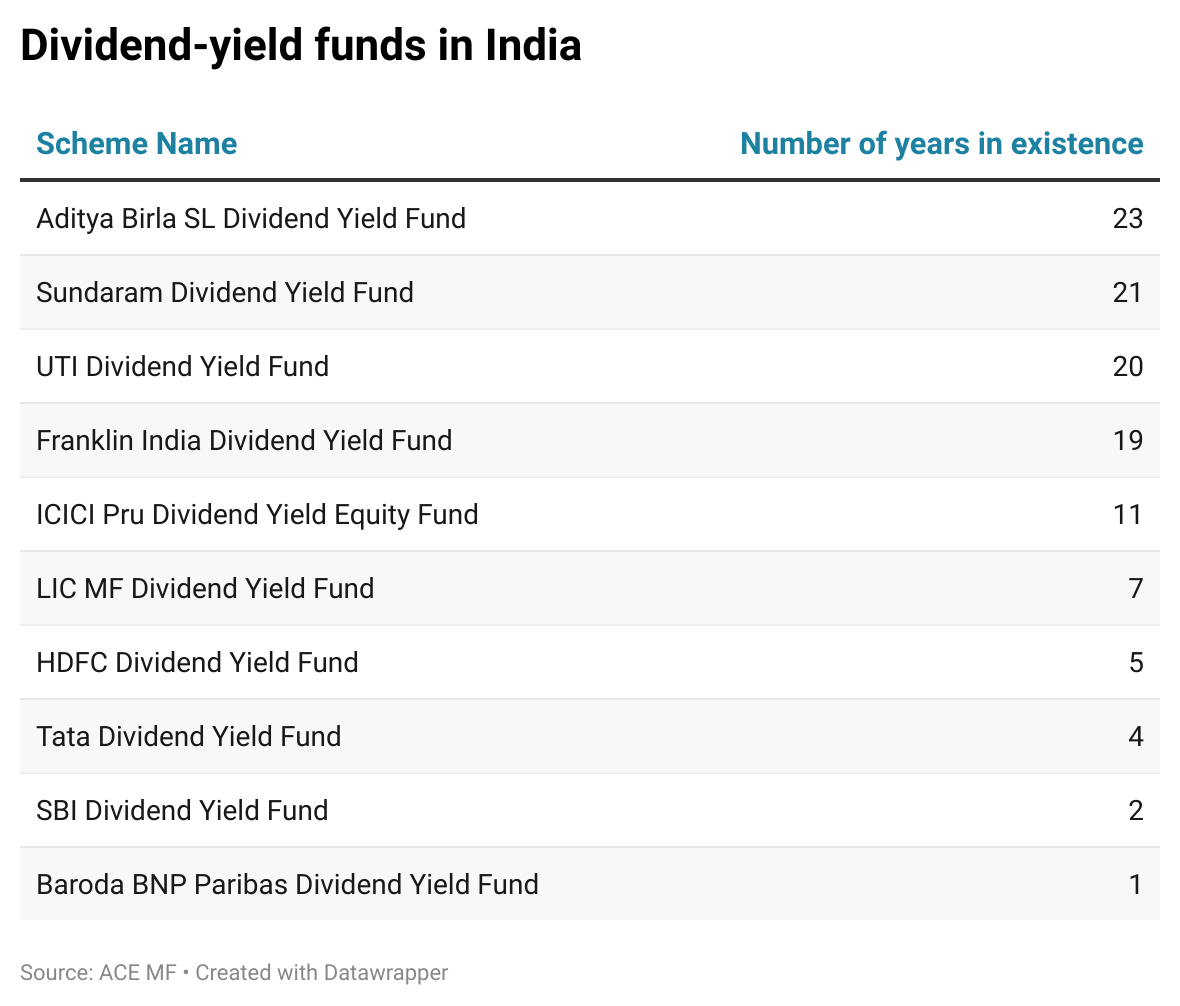

Four dividend funds were also operating in 2008. During crisis times, these funds, too, fell lower than the broader market index.

Observation -2

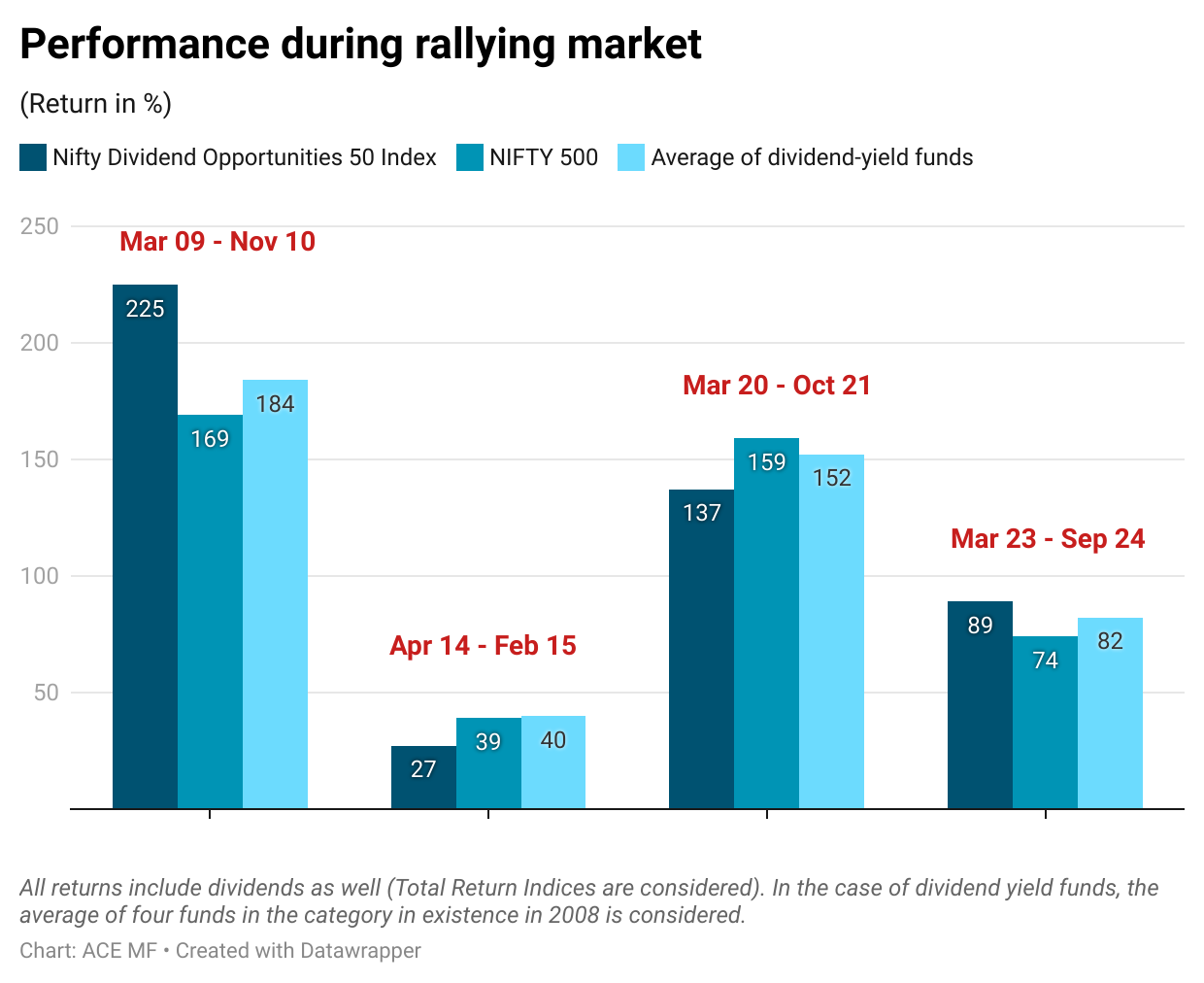

The second observation is about how they performed when markets are rallying.

It's intuitive to think that stocks that fall less when markets correct tend to go up more slowly when markets recover.

Having said that, the returns from these dividend-paying companies during rally periods give a mixed picture. See the image below.

There are times the dividend index outperforms in the upcycle, and there are times it lags.

Now, there's a point you need to note here. Since the dividend index also includes many PSU companies, which are valued on the lower side, they fit in the 'value stocks’ bucket (in the debate of value vs growth stocks).

When markets are in momentum mode, they usually favor companies that are growing fast. But there are also times when the market favors value stocks - the recent rally from March 2023 to September 2024 was a case in point.

The key takeaway here is that dividend stocks don't always outperform/underperform during rallies—it also depends on whether the market is favoring growth or value at that time.

Observation 3

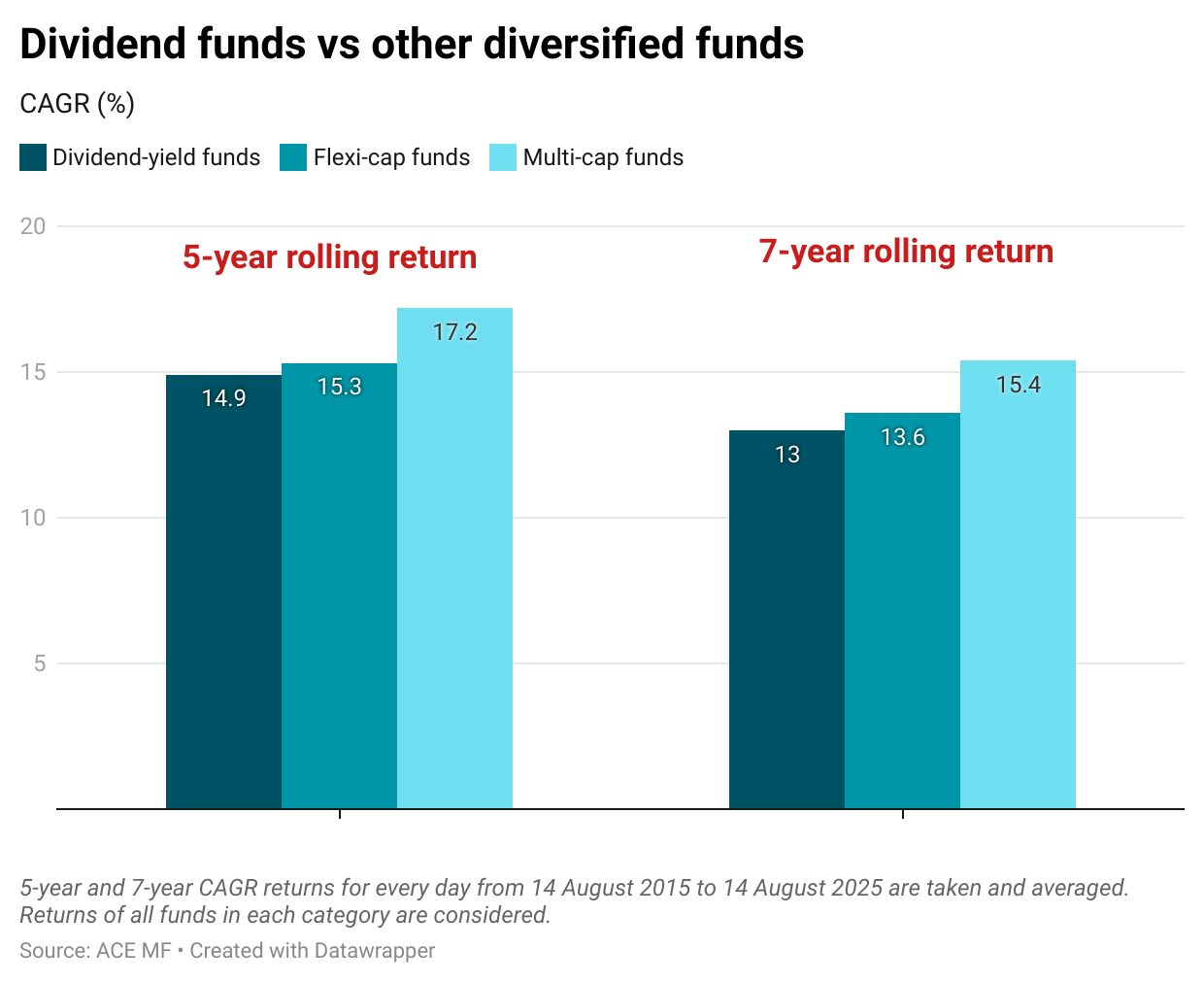

Now, let's look at how this category performed compared to other mutual fund categories like flexi-cap/multi-cap funds over a long period of time.

All three categories invest across sectors and have stocks from large, mid, and small-cap categories.

We looked at the 5-year and 7-year returns of these funds every day from August 2015 to August 2025. This is called rolling returns.

The average of these returns shows that dividend yield funds lag behind other categories.

This could be because fund managers in the latter categories have the flexibility to pick stocks based on a company’s fundamentals and outlook rather than just focusing on a specific theme (like dividend-paying companies).

Wrapping up

First, dividend yield funds aren’t designed to give you regular dividends.

If you want periodic income, you can set up an IDCW (Income Distribution cum Capital Withdrawal) option or a Systematic Withdrawal Plan (SWP) from any fund. SWP options are much better in terms of taxation.

You don’t need a dividend yield fund for that. Whether it's IDCW or SWP, the money still comes out of your own capital, and with every payout, either the fund's NAV (net asset value) drops or the number of units you hold in the fund goes down.

Next, the three observations about dividend yield funds are:

They are better at cushioning the downside when markets correct.

They delivered a mixed performance during rising markets.

Over the long run, they haven’t beaten diversified peers.

So, it’s a trade-off.

If you want your investments to fall less when markets correct, dividend yield funds could suit you.

And if you want both protection and outperformance, remind yourself that "investing is choosing which regret you can live with"(either accept bloodbath in bad markets, or accept not leading the pack when markets rise). You can't get it all, at least, it's not that easy.

That said, some diversified mutual funds in the flexi/multi-cap category aim to balance both. Here, though, the fund's selection matters a lot.

This Newsletter was written by Satya Sontanam.

Do read How can dividends exceed earnings? newsletter on our Side Notes by Zerodha Varsity.

For any feedback or topic suggestions, write to us at varsity@zerodha.com.

The common confusion is that these funds are designed to give you a steady income, or that by investing in high dividend-paying companies, they somehow pass bigger dividends to you.

The truth is, these funds are just like any other mutual fund category, such as large-cap, mid-cap, or value funds.

The Second Oder by ZERODHA VARSITY demystifies the point of dividend-yield mutual funds in such convincing way and simple words.I fail to understand why the mutual funds don’t tell us such things despite SEBI/AMFI disclosure requirements. My take:

—The only difference is that they focus on companies known for consistently paying dividends.