Silver or Gold: What's a better investment?

These precious metals serve one main purpose in a portfolio: they offer protection during times of crisis.

You’ve probably seen Olympic winners biting their medals on the podium. It’s become a gesture to celebrate victory. But the act of biting into metal actually traces back to a much older practice.

Pirate movies popularised the image of swashbucklers sinking their teeth into gold coins to check if they were real. The logic was that the purest form of gold and silver is very soft, so a bite would leave a mark. That dent was proof that what they were holding was real.

But as an investor today, you don’t need to bite into anything to test the purity. Especially now, with digital gold and silver-backed ETFs, owning precious metals has never been more accessible or, actually, bite-free.

The real test is about understanding how these precious metals fit into your overall investment portfolio.

Silver has started to perform well lately, and many investors have been wondering whether it’s time to go heavy on silver or hold both gold and silver.

What if you had invested ₹100 in gold and silver a year back?

Let’s take a closer look at both metals and what they bring to the table.

But, first things first…

I hope you understand that you can't just go all in on gold or silver (or both) and call it an investment portfolio to build wealth. Because that's not what they're meant for.

We discussed this in one of our previous newsletters on gold (one of my favourites) and its role in an investment portfolio.

Gold is not an asset that beats equity in the long run, nor is it an inflation hedge all the time, but a safe haven during global crises.

Silver, a precious metal and an industrial commodity, behaves somewhat similarly, yet it has its own dynamics that are different from gold's.

However, given the generalisation of gold and silver as investment vehicles, it makes sense to compare these two metals on three parameters.

Returns (What can you expect to make)

Volatility (How much the asset’s ups and downs mess with your peace of mind) &

Correlation (What’s the point of adding something new if it behaves exactly like what you already have?)

What about the returns?

Both gold and silver prices are driven by supply-demand factors and broader macroeconomic conditions.

When it comes to gold, the demand mostly comes from:

Central banks

Investments from retail Investors and institutions

And of course, jewelry demand

A large portion of silver demand comes from industrial applications, including electronics, solar panels, EV auto companies, and medical devices.

If you held these metals for the last 30 years, from 1995 to the present, your returns from the yellow metal would have averaged 7.5% per annum.

During the same period, silver would have returned an average of 6.85% per annum.

These returns are based on USD values. Add rupee depreciation of about 3% per annum, and you would have returns in the range of 9.8 % - 10.5%.

What if you had invested ₹100 in gold and silver in 1995?

To give a perspective, during the same time period, the Nifty 50 (representative of the Indian stock market) delivered about a 12% return.

We can’t say for sure which will do better in the next 30 years, between gold and silver. If we just go by history (considering multiple time periods, even within the last 30 years), it would probably be gold.

Volatility is in its nature

There’s an old adage on silver - that it is part metal and part madness. And it is for a reason. Silver is more volatile than gold and even equity.

Silver's market is much smaller than gold's or the stock market's. That means even modest buying or selling can dramatically swing prices.

Is there a correlation?

Harry Markowitz, known as the father of modern portfolio theory, said that to get the best results in terms of both risk and return, you should mix assets that don’t move in the same direction.

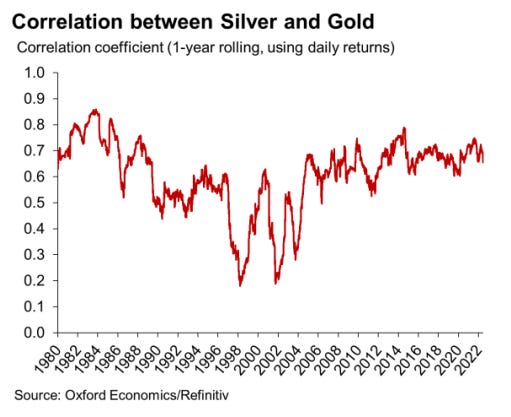

Now, look at gold and silver. Their correlation is high. Typically, a value above 0.5 is considered a high correlation.

The correlation between gold and silver is around 0.7. This means that when gold prices go up, silver prices tend to go up as well, and vice versa.

So, holding both doesn’t add much extra value. If you already have gold, adding silver won’t diversify your portfolio much, and the same is true the other way around.

For those of us who already have equity exposure, gold makes more sense, as it is less correlated with stocks than silver.

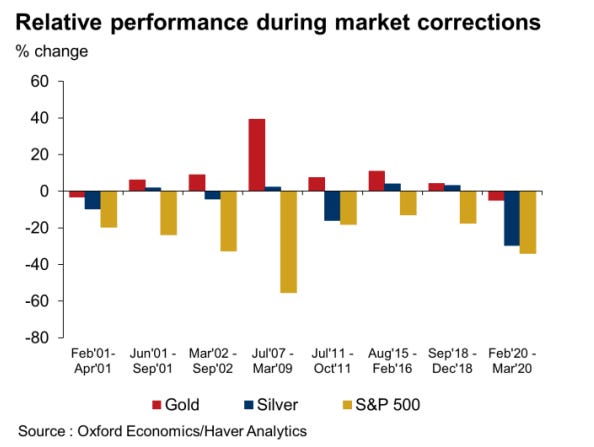

Also, during times of crisis, gold has been a better hedge than silver.

So, should you invest in gold, silver, or both?

Looking at volatility, returns, and correlation, gold stands out as a better fit, especially for a long-term, equity-heavy portfolio.

Why?

Gold is less volatile than silver, meaning it doesn’t swing as wildly.

It has delivered better historical returns over long periods.

It has a low correlation with equities, which helps cushion your portfolio when markets fall.

Most importantly, during crisis periods like the 2008 financial crisis or the COVID-19 crash, gold has consistently held up better than silver, acting as a safe haven.

Now, does that mean silver has no place? Not quite.

Silver can still be used as a tactical investment, something you add when there’s a short-term opportunity, like a severe supply-demand mismatch, industrial demand, or a momentum rally.

But here’s the thing: tactical calls require timing the market, knowing when to get in and when to exit. And that’s hard to do. Most investors don’t have the tools, data, or temperament for it.

So, for a hedge during crisis periods and a relatively smoother ride, gold makes more sense.

And at Varsity HQ, we believe that if timing isn’t your strength, the asset might be better left out of your core portfolio.

This newsletter has been put together by Satya Sontanam and Apurva Gururaj. If you have any feedback for us or something you’d like for us to cover in the upcoming newsletters, do let us know. Mail us at varsity@zerodha.com

Valuable article and beginner friendly. Love how Data Analytics plays an important role in planning investments and understanding average returns.

Getting rich in short periods is rare but advertised alot as golden opportunity, but turns out that our greed for more never lets us sell investment at right time and we end up with average returns which is what we should always look for for safety in long terms.

It makes sense. Thanks for sharing Zerodha VA.