Last week, gold touched the ₹1 lakh mark, and investors' focus shifted from the stock market to gold.

Many of us grew up hearing that gold prices “only go up”. We see it as a safe asset, as if nothing can ever go wrong when you invest in gold.

As gold rallied, Indian businessmen like Uday Kotak and Harsh Goenka took to Twitter, cheering Indian housewives' instinct to hoard gold.

It’s nice to read. It's a validation of our decision to invest in gold. But with all due respect, let’s pause before we put a halo on this asset. Let’s dig into the numbers and ask two simple questions:

1) What can we expect from investing in gold? 2) How much of it should we actually hold in our portfolio?

Let’s look at returns…

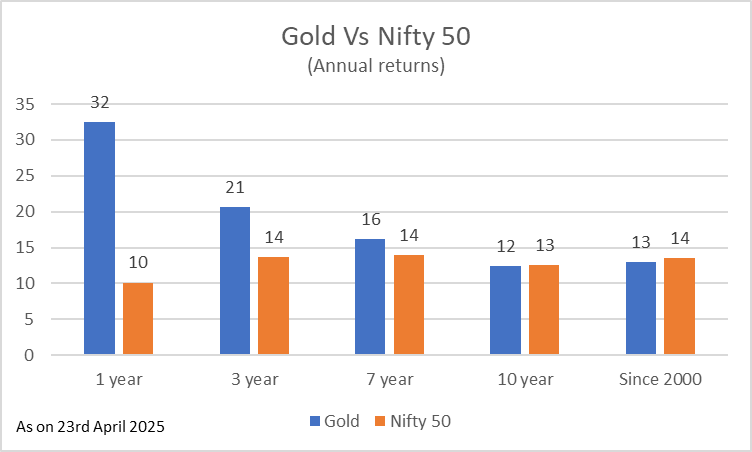

Say you held gold for one year, three years, or even longer, like seven or ten years as of now.

Returns from this humble, centuries-old asset would have either matched or outperformed equities by a large margin.

That’s interesting.

But judging an asset class based on returns from just one point in time (as of April 2025) is called Point-to-Point bias. Because you're drawing a conclusion by looking through the lens of a single moment, not the full picture.

So, let’s ask ourselves if gold returns has always been this good?

The answer is no. There have been periods of under performance, too.

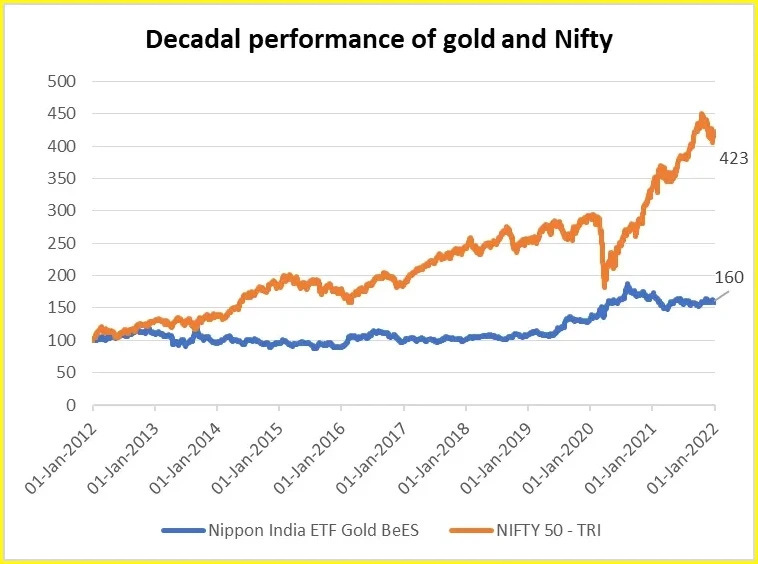

For example, as of 2022, gold was the decade’s under performer. Even after holding it for more than 10 years, one would have earned just 4.8% annual returns from this yellow metal.

In stark contrast, the Nifty 50 delivered 15.5% annually over that period. Let’s look from a different angle too…

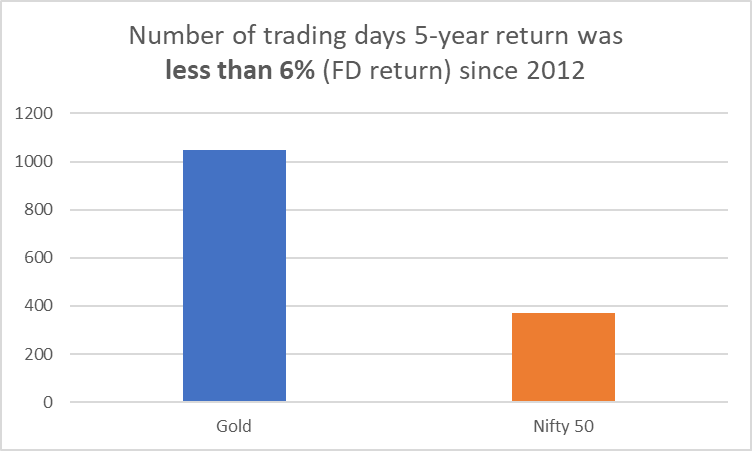

We looked at gold and equity returns since 2012, which gives us more than 10 years of data. This isn’t a large enough dataset, but it gives us a fair idea.

During that period, had you held both assets for over 5 years, you would have seen that equities often beat returns from gold.

You see, comparing equity and gold isn’t ideal either. Both are different asset classes that serve different purposes.

Gold is a commodity, and its price usually depends on supply and demand and what’s happening globally.

Equities, on the other hand, are designed to generate returns through dividends and capital appreciation, backed by growth of the businesses.

What I am trying to highlight is that both equity and gold are cyclical assets, which means their performance fluctuates over time.

If growing wealth is your goal, equities are generally preferred because of their very nature. So, what role does gold play?

Roles that gold plays

Gold has been around for more than 5000 years. And it’s always been seen as something precious.

Kings hoarded it, central banks collected it, and people wore it as jewelry, not just as accessories, but also as a symbol of wealth and status.

Because it’s been around for so long, it has taken on many roles. Most commonly, it’s known for:

Beating inflation

Protecting against currency depreciation (like the rupee)

Acting as a safe haven during global crises

Inflation-beating? Yes, but…

Back in 1977, a professor introduced a concept called the “Golden Constant” the idea that gold maintains its purchasing power over time.

What does that mean?

If you could buy a high-quality watch in 2000 with a gold coin, you could do the same in 2020, even though the value of that watch may have increased multifold.

This way, gold acts as a store of value. But is that what the data suggests?

Short answer: Over the very long run, yes. Gold tends to beat inflation. But in the short term? Not guaranteed.

In a well-known research paper titled “The Golden Dilemma” (2013) by Claude B. Erb and Campbell R. Harvey, the authors wrote:

“Even if gold is a 'golden constant’ in the long run, it does not have to be a golden constant in the short run (upto 10 years)”

So, if you expect gold to always beat inflation on a yearly basis, you might be disappointed.

Protection from rupee depreciation?

Gold is primarily priced in USD.

When the rupee weakens against the dollar, you need more rupees to buy the same amount of gold, which pushes up the gold prices.

This appreciation helps offset the rupee’s fall.

For example, from 2012 to 2020, gold in USD terms was negative, but in rupee terms, you would’ve earned around 3% per annum entirely from rupee depreciation.

But here’s the catch: if global gold prices fall after you invest, rupee depreciation won’t be enough to save your returns.

The true value of gold

If there’s one thing gold has consistently done well, it’s this: it cushions your portfolio during times of crisis.

Whether it's wars, recessions or any global uncertainty, people turn to gold as a safe haven, and that demand often pushes its price up.

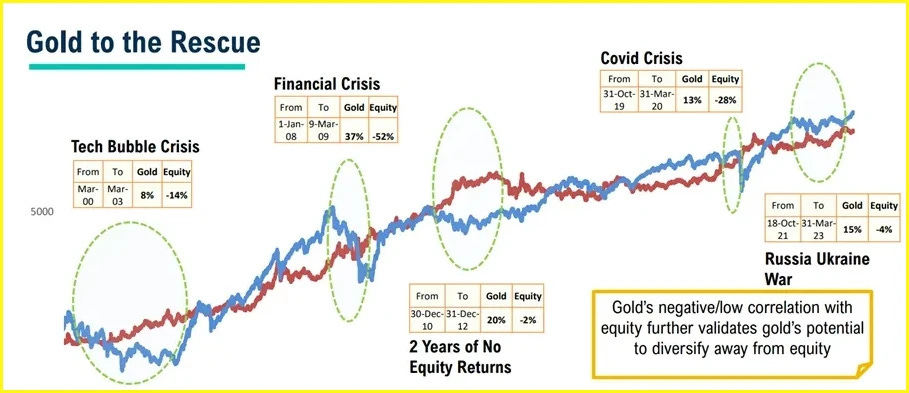

Look back at some major events:

From the dot-com bust and 9/11 attacks (2000–2003), the 2008 global financial crisis, the COVID crash in 2020, the Ukraine war (2022–23), to the recent trade wars and whispers of another recession - in all these phases, gold prices rallied over 10%.

These are the same periods when equity markets tend to panic and fall.

So gold gives some cushion to your portfolio during such times.

Source: DSP Mutual Fund

So, how much should you invest in gold?

Well, as we’ve seen, gold isn’t meant to grow your wealth the way equities can. Instead, it plays a different role - it helps protect your portfolio during times of crisis.

So, how much gold you hold depends on what you value more: Growth or protection against sharp market crashes.

For someone building wealth, most financial planners suggest keeping just about 5–10% of the portfolio in gold.

Finally, here’s our take…

Celebrate the current rally in gold. But no, don’t rush to bet your future on it. If you’re trying to time the rally - good luck investing and exiting at the right times.

But if you’re allocating gold as part of a balanced portfolio, it has its place. And that’s where we should leave it.

PS: If you are interested in trading gold to profit from short-term price movements, watch this video.

What makes gold price go up?

Inflation & interest rates

When inflation rises or interest rates are low, people buy gold to protect their money.

But if interest rates are high, people prefer to keep money in banks or bonds (they earn more there), so gold demand drops.

USD vs Gold

Gold is priced in US Dollars. If the dollar weakens, gold becomes cheaper for other countries to buy = demand rises = price goes up.

Central bank buying

If central banks (like RBI, Fed) buy more gold to hold as reserves, prices go up.

Geopolitical tension or crisis

Wars, elections, banking collapses = people panic = gold demand shoots up = prices go up.

Demand from industries or jewellery

High wedding seasons in India or festivals = more demand = higher prices.

And what makes it fall?

High interest rates

Strong dollar

Low inflation

People selling gold to book profits

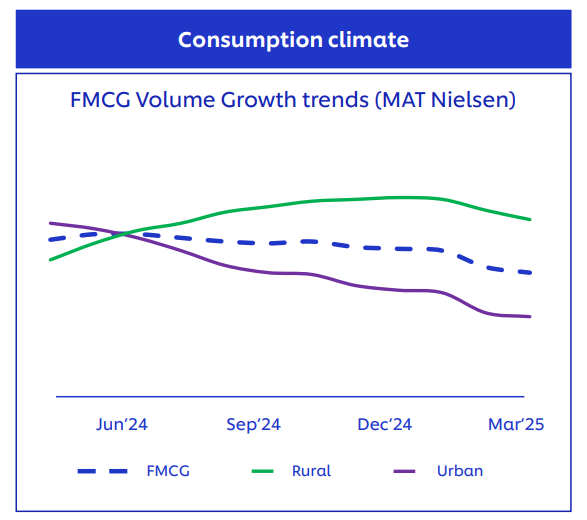

HUL’s FY25 revenue grew just 2%, driven entirely by a 2% volume uptick—signaling flat pricing power. But the bigger worry is perhaps the slowing urban demand.

A few reasons why there is a slowdown:

Urban consumers might simply be cutting back.

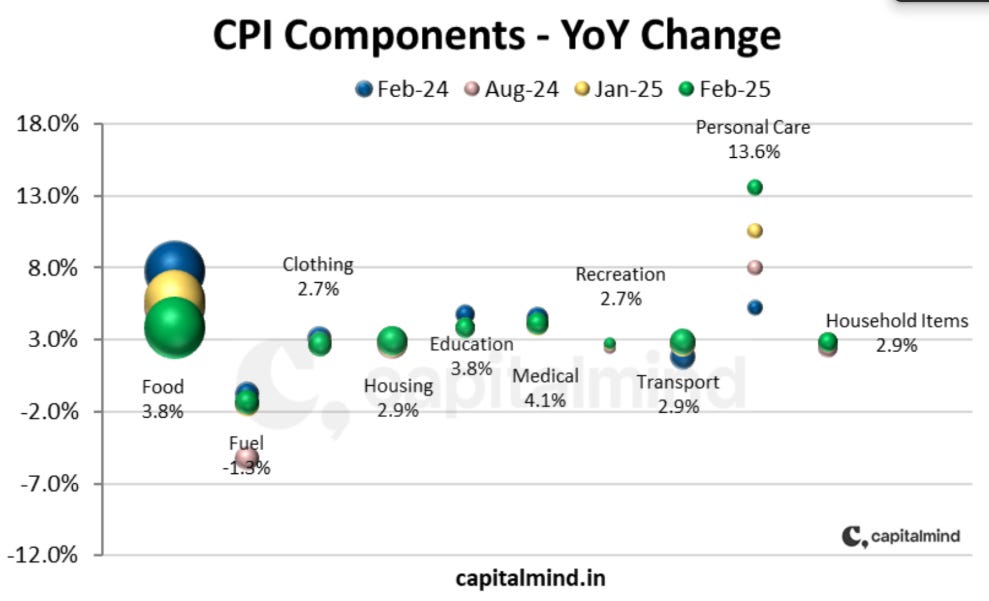

Inflation remains sticky, especially in personal care products (a major HUL segment).

D2C disruption: A flood of e-commerce-first personal and home care brands may be chipping away at HUL’s urban dominance. Individually small, collectively significant.

It’s likely a combination of all three i.e. weak consumer sentiment, inflation pinch, and rising D2C competition that is dragging urban volumes down.

Chennai folks - you have raised the bar higher! Varisty’s team from Bengaluru could not decide if the Idly, Dosa and Sambar is better at home or Chennai and if we love Kohli or Dhoni more but the crowd was 100% lit and the vibes were definitely richer than everyone’s portfolio and we loved hosting such a brilliant crowd. We thank Vidya Bala for sharing such valuable knowledge. Thank you for such a wonderful response Chennai :)

This newsletter has been put together by Satya Sontanam, Apurva Gururaj, and Vineet Rajani. If you have any feedback for us or something you’d like for us to cover in the upcoming newsletters, do let us know. Mail us at varsity@zerodha.com

This is first time when I got new thing in my feed, thanks Zerodha, keep putting these types of articles on my notification 😊