Why do bubbles actually form?

It all starts with a sound premise…a grain of truth that mutuates into mania.

Plenty of experts have their take on how bubbles end up being created. But my favourite explanation and I think the simplest one is by Warren Buffett, who, in turn, got the idea from his mentor Benjamin Graham.

So I’m going to use that as the foundation for this edition of Tell Me Why.

See, the most common theory for why bubbles form is that it’s psychological. It’s not really economic.

It's when your dumb neighbour takes a bet on a stock and walks home with a bag full of money. Your insides burn with envy when you think why you didn’t buy that stock. You’re greedy to prove that you can even make money so you get in on the action even though you understand zilch about what you’re about to buy.

And when enough people do the same thing and fall prey to this contagion of greed, no price is too high to click buy. This obviously pushes prices alarmingly higher and eventually creates a bubble.

But this theory is an insult to our collective intelligence. It strips us down to our most primitive behaviour — envy and greed.

Rather, the Graham-Buffett Theory of Bubbles (I’ve nicknamed it this way) is more nuanced. They say the truth is that economic bubbles usually begin not with obvious nonsense but with a sound premise that slowly mutates into collective madness.

Those are my words, not theirs. And I’ll explain.

Think of the nonsensical premise or a false premise as something that’s completely and utterly unbelievable. Imagine a company saying they’re going to build houses on the moon for the human race to repopulate there. Hardly anyone is going to buy into that idea and it’ll never become mainstream enough to create a bubble in that stock.

On the other hand, a sound premise actually has merit. And I’m going to use an excerpt from a fairly obscure interview of Warren Buffet from 2010, when the US set up the Financial Crisis Inquiry Commission (FCIC), to explain this. He was talking about how the housing bubble formed and popped among other things. And I’ve edited for clarity and brevity.

It’s a totally sound premise that houses will become worth more over time because the dollar becomes worth less…and that a house that was bought 40 years ago is worth more today than it was then.

And since 66 or 67 percent of the people want to own their own home and because you can borrow money on it and you’re dreaming of buying a home, if you really believe that houses are going to go up in value, you buy one as soon as you can. And that’s a very sound premise.

So this sound premise that it’s a good idea to buy a house this year because it’s probably going to cost more next year and you’re going to want a home, and the fact that you can finance it gets distorted over time if housing prices are going up 10 percent a year and inflation is a couple percent a year…at some point the price action takes over, and you want to buy three houses and five houses and you want to buy it with nothing down and you want to agree to payments that you can’t make and all of that sort of thing, because it doesn’t make any difference: It’s going to be worth more next year.

And [the] lender feels the same way. It really doesn’t make a difference if it’s a liar’s loan [where the lender does not even ask for proof of income]…because even if they have to take it over, it’s going to be worth more next year.

And once that gathers momentum and it gets reinforced by price action and the original premise is forgotten,...

And because people] understood houses and they wanted to buy one anyway and the financing, and you could leverage up to the sky, it created a bubbles like we’ve never seen.

Put simply, bubbles are not just caused by naked greed alone. Rather, there’s a pattern to every mania or bubble:

A grain of truth that gets people to believe in a safe and reliable premise

The stretching of the truth as more people jump on board and build a narrative on top of the original premise

Greed causing reckless behaviour — such as overloading on leverage

And even the smartest people can fall prey to this. I’m talking about Sir Isaac Newton, the man who practically discovered gravity. You’d say he truly understood the concept of things coming back down to earth, but that didn’t make him t immune to the madness of the crowd.

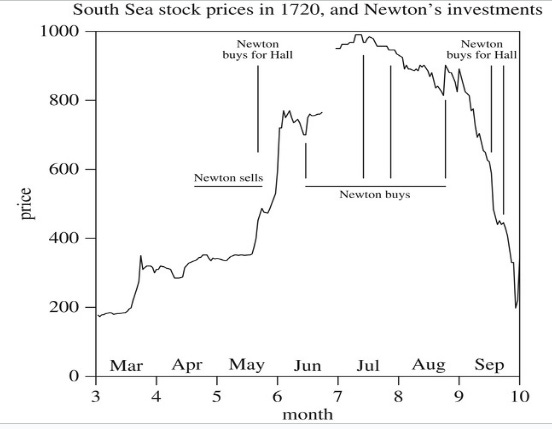

In the 1720s, England’s South Sea Company had secured a virtual monopoly on trade with the west Americas and investors believed buying a piece of it would make them extremely rich.

Isaac Newton made an investment in the company too. And when he saw the stock rally, he pocketed a handsome profit and exited.

But his dalliance with the South Sea Company didn’t end there. The stock continued to rally and Newton sat on the sidelines watching other fools make more money than him. He couldn’t bear it so on one fine day he jumped right back in with a big chunk of his savings.

Unfortunately for him, the hype bubble soon burst, the stock crashed, and he lost a small fortune.

Note: ‘Hall’ in the image is the Estate of a British civil servant named Thomas Hall that was managed by Isaac Newton

Source: Newton's financial misadventures in the South Sea Bubble by Andrew Odlyzko

On the face of it, the investment premise was sound a monopoly on trade meant that there was really no competition for the firm.

But that good idea became dangerous once people lost sight of the limits and paid ridiculously high prices for the stock.

And you could apply the same principle of (most) bubbles. Remember the dotcom bubble of the late 90s based on the sound premise that "the internet will transform business."

It was absolutely correct, It did revolutionize everything shopping, communication, work…the list goes on. And the most valuable companies in the world are companies built on the foundations of the internet.

However, investors who bought into this sound premise without regard to the price or valuation got crushed.

You see, whether it was the 1700s or the 2000s, it’s the same thing. The cycle repeats.

Always.

So what's an investor to do, you ask?

Well…the internet was revolutionary. Houses do appreciate over time. AI will transform society. But great ideas don't justify stratospheric prices.

That means the next time you hear a perfectly logical investment thesis, or see that dumb neighbour getting rich off of an investment bet, remember to ask yourself the most important question of all - "At what price does even a sound premise become unsound?"

That should hold you in good stead.

Anyway, that’s one of the theories on how bubbles form and I’d love to know what you think. Whether you agree or disagree, drop your thoughts in the comments.

This Newsletter was written by Nithin Sasikumar.

Do read Homebuyers, don’t fall for subvention schemes newsletter on our Second Order by Zerodha Varsity.

For any feedback or topic suggestions, write to us at varsity@zerodha.com.

Absolutely right. After Covid, a huge bubble was created in cryptocurrency. Many people rushed to invest, putting in a lot of their hard-earned money. When the market crashed, their money got stuck, and even today many are facing losses. A similar trend was seen with NFTs—people invested heavily, especially when companies promised double returns. But now, those companies have disappeared, and hardly anyone talks about NFTs anymore.

So, can we consider Gold is in Bubble territory Now (or) as countries shifting from US treasuries to Gold - its not a bubble ?