Warren Buffett and different types of moats

Buffett emphasized buying quality businesses with moats. Moats can be of different types like Coca Cola's brand identity or Apple's product design.

If you have watched any historical movie or one with a historical setting — kings, queens, and battles — you would have noticed a castle or fort surrounded by water on all sides.

When the castle’s gate opens, it usually opens vertically from the top end, which falls on the other side of the water, effectively creating a bridge.

Going in and out of such a castle can happen only when the bridge is laid out.

What is the purpose of this structure? It is meant to protect the castle from invaders. With water on all sides, the castle becomes inaccessible to invaders.

This protective structure of a large depression surrounding the castle, filled with water, is called a moat. The structure may or may not have water. But any depression or any structure that protects the castle from its rivals is called a moat.

The same principle applies to businesses as well.

Warren Buffett popularized the term moat in the context of businesses. He has always preferred investing in companies that have an economic moat. But what is an economic moat?

Any feature that makes it difficult for the competition to break into an existing business’s market share is called a moat.

Warren Buffett invested in Coca-Cola, Apple, and several other consumer companies because each had a moat. Coca-Cola’s brand identity is a moat, and Apple’s brand and product design are both moats.

But building a moat is hard, and defending it is even harder. Today, we’ll explore three fascinating stories of companies with strong but different types of moats.

By the way, you can listen to this newsletter on Apple Podcasts or Spotify.

Nestle

Nestle’s Maggi enjoys a moat. Maggi has been the go-to instant noodle brand for more than two decades, if not three. In fact, Nestle was the one to introduce the concept of instant noodles to Indian consumers, and Maggi was the only option for the longest time. A few smaller brands emerged, but none could match Maggi’s taste and reach across the length and breadth of India. Then, ITC launched Yippee noodles in 2010. It was seen as a worthy competitor, but it could not unseat Nestle’s Maggi.

In a shocking turn of events, however, in 2015, Maggi was taken off the shelves for claims of high MSG and lead content in the two-minute noodles. Maggi’s sales came down to zero. When the ban was lifted a few months later, people bought Maggi as if nothing had happened. It was as if there was no health scare. That is how strong Maggi’s brand image was, and that is how much people liked the taste of Maggi noodles. It is true to this day.

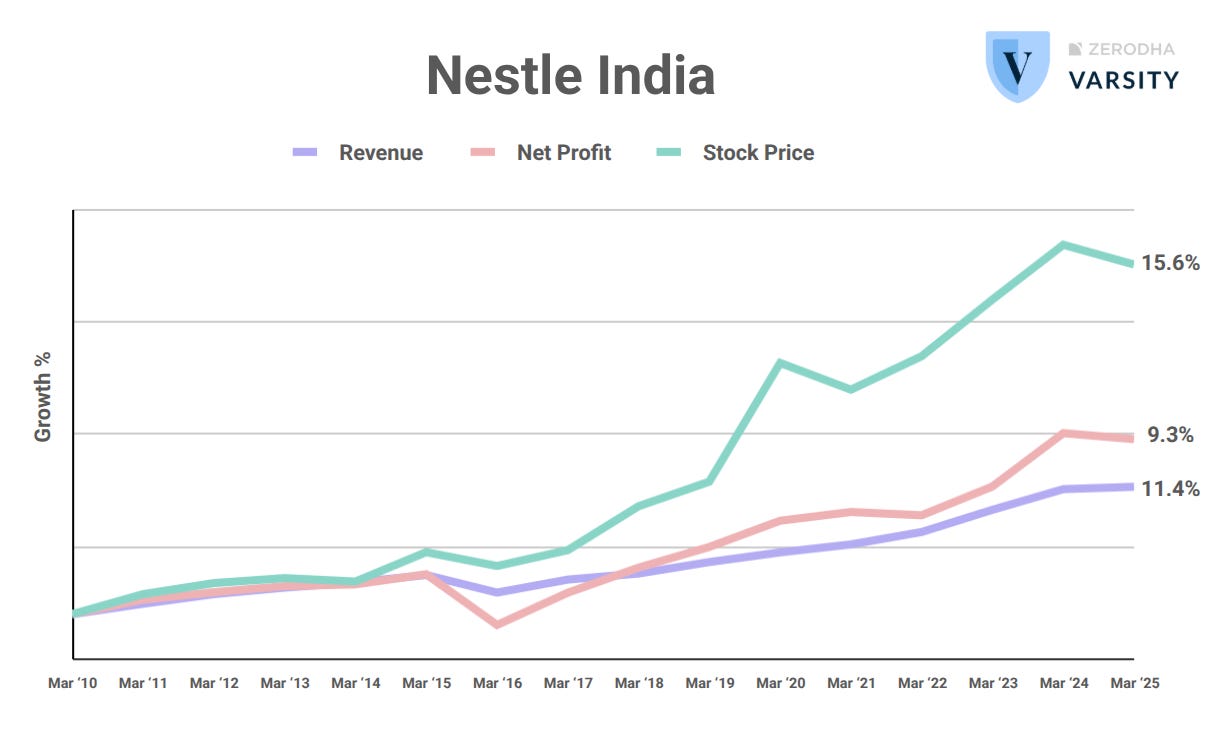

Nestle Maggi’s position is unshakeable because it is protected by the moat of its brand and product. Perhaps the market realizes that, too. Since Nestle got listed on the Indian stock exchanges in 2010, its revenues and net profits have averaged growth of 9% and 11%, respectively, between FY 2010 and FY 2025.. At the same time, the stock compounded at over 15% annually.

Sometimes, it is not the brand or product, but a unique offering that could become a moat. Dmart is an example.

Dmart

People go to Dmart because of the deep discounts it offers on groceries. It also offers extremely affordable appliances, kitchenware, and apparel. Dmart is a haven for price-conscious shoppers.

And how does Dmart do that? By buying in bulk directly from manufacturers. In doing so, middlemen are eliminated. Therefore, Dmart can buy at really cheap prices. And that is also why it can sell at such cheap prices.

Moreover, Dmart kept its costs low by not growing aggressively. It adds only a few stores every quarter, and you will see that it follows a cluster strategy of expanding its network of stores. It started first in Maharashtra and gradually moved to neighboring states. Dmart still does not have a pan-India presence. It has the capital to grow more and grow faster, but it chooses to validate the business model every time for profitability and scalability.

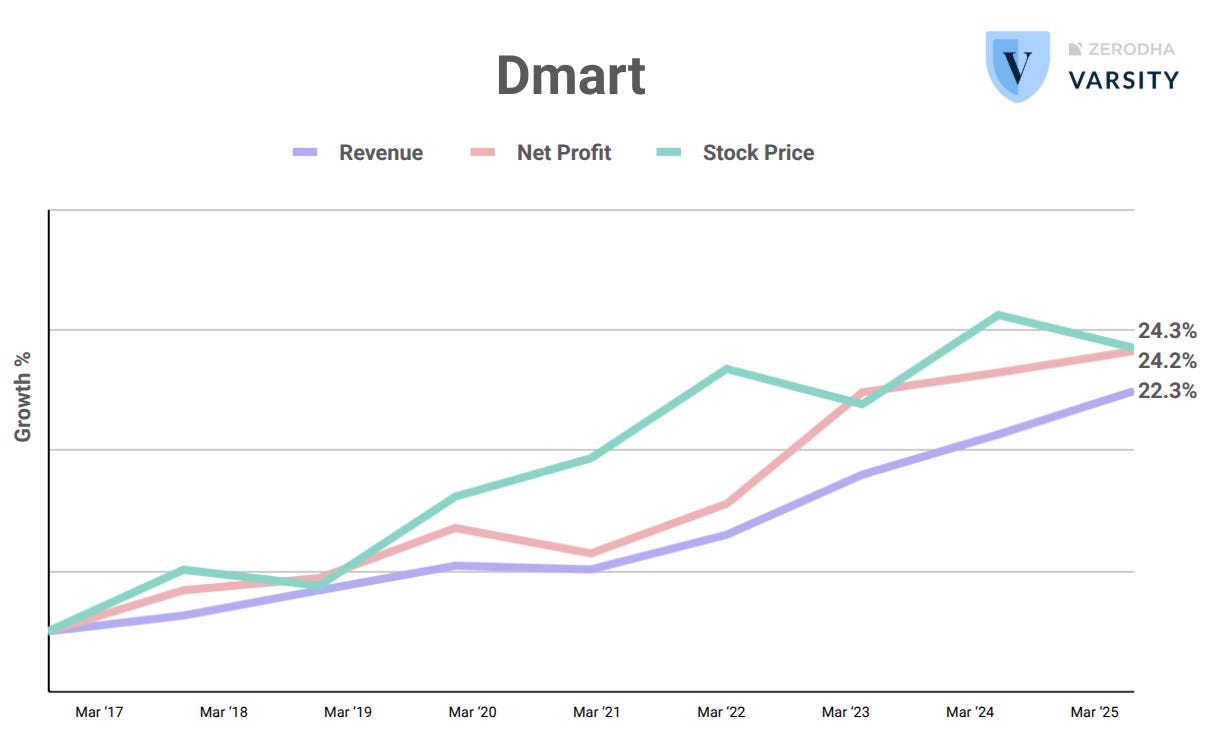

This has resulted in super-affordable goods for shoppers. So, Dmart’s unique offering, or the deep-discount model, is its moat. And it reflects in Dmart’s share price. Since Dmart got listed in 2017, its share price has grown at about 24% CAGR, while revenue and net profit have grown at a CAGR of 22% and 24%, respectively.

IRCTC

IRCTC enjoys a regulatory moat. No matter which online portal you reserve your train ticket from, your booking is routed via IRCTC. Why so? The Indian Railways has granted exclusive rights to IRCTC to provide online railway ticketing services in India. So, IRCTC makes money on every online train reservation in this country.

As per the FY25 annual report, IRCTC also holds the exclusive rights to provide packaged drinking water and catering services at railway stations and on trains across India. IRCTC might offer catering services through other vendors or on its own.

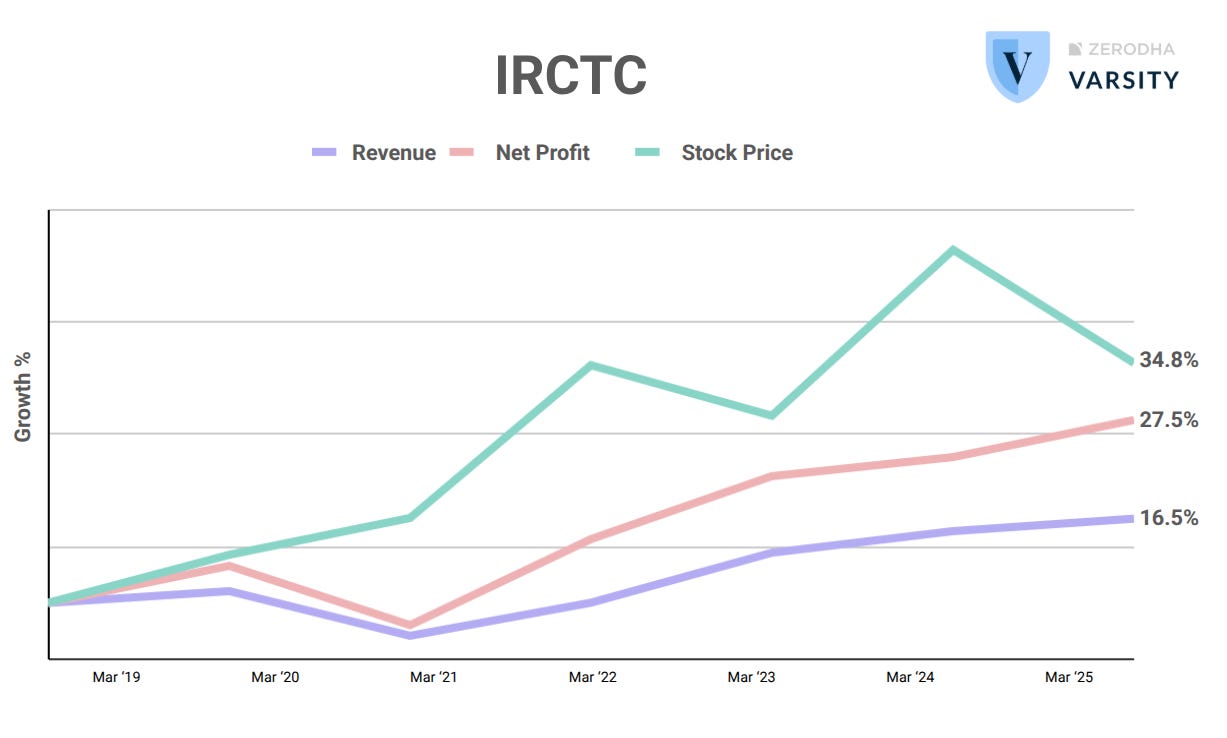

Since its listing in 2019, IRCTC revenues have grown at a 16% CAGR and net profit at a 27% CAGR. Both monopoly and scale economy seem to be playing in IRCTC’s favour, resulting in such strong growth in profit compared to revenues. The stock has grown at a CAGR of 35% over the same period.

IRCTC enjoys a monopoly, which we call a regulatory moat because the government protects its business. As long as regulatory protection exists, this business is a cash cow, but that itself is a risk. What if the government were to allow privatization or railway ticketing? IRCTC’s moat could disappear. That’s something to think about.

To sum up, Nestle Maggi’s brand leadership, Dmart’s cost leadership, and IRCTC’s regulatory leadership are moats. These moats have helped build significant business and shareholder value. There could be other types of moats. Can you think of any?

This Newsletter is written by Vineet Rajani.

Do read “Why should central banks be independent?” in our newsletter, Tell Me Why by Zerodha Varsity.

For any feedback or topic suggestions, write to us at varsity@zerodha.com

An excellent article to understand the moat. Thank you.

Great article, The maggie thing is so real, no one talks about other brands...