The actual cost of no-cost EMI

Sellers and banks want you to buy on EMI, but here’s what you need to know.

My friend Rohan recently bought a laptop, and we were discussing its specs, on how slim and lightweight it is.

As the conversation drifted toward the cost, he mentioned that it's priced at ₹1.28 lakh and that he was paying for it via EMI (equated monthly instalment).

The personal finance writer in me immediately switched to a preachy mode.

Me: “Dude! Why would you buy a laptop on an EMI? Don’t you know it’s a depreciating asset? Its value only goes down over time, and you're taking a loan for it, paying extra in the form of interest. As per the personal finance rules...”

Before I could finish, he interrupted me.

“Who said I’m paying interest on it?” he said, explaining that he opted for a no-cost EMI because it came with a discount of ₹8,000.

Until a few years ago, sellers usually gave discounts to buyers who paid the full amount upfront.

But these days, sellers and financiers are actually encouraging us to postpone our payments by choosing EMI options.

And it’s very clear. EMI options often come with better discounts.

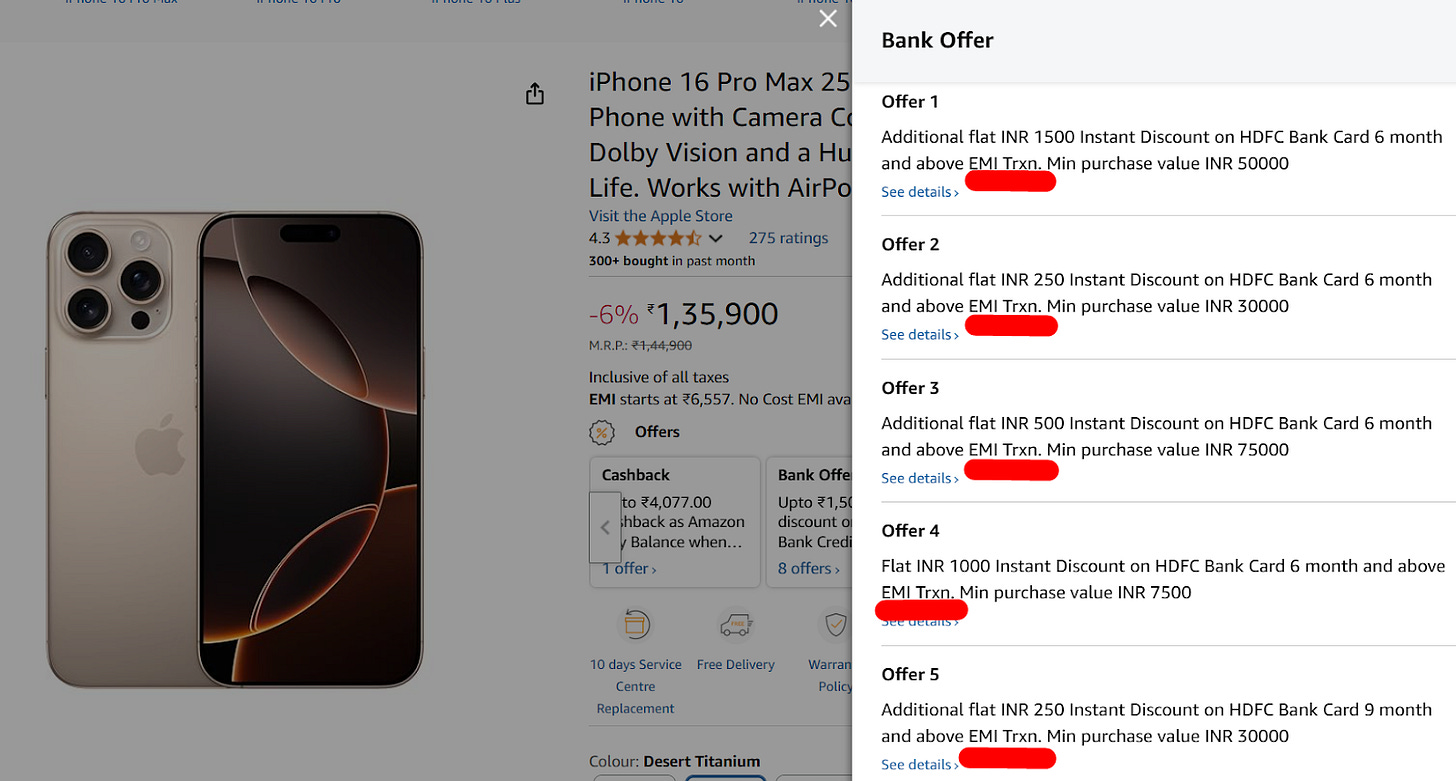

I browsed through e-commerce platforms, and here’s how the options usually appear for credit card payments:

Upfront payment - May or may not come with a discount.

Standard EMI with interest - You pay interest (15%-16%) on the borrowed amount; some discounts may be offered on the cost.

No-cost EMI - No interest is charged to the buyer, and it may come with discounts.

For consumer durables, the general advice has always been to pay upfront, and if there’s a discount, that’s a bonus.

The second option, standard EMI with interest, is an absolute no-no! Even if there’s an alluring discount on the cost, the total interest paid usually is higher than the discount.

But what about the no-cost EMI (NCEMI)? Is it a good option? Let’s see.

As I said, Rohan bought a laptop worth ₹1.28 lakh on a 12-month NCEMI plan with an instant discount of ₹8,000. The after-discount cost came to ₹1.2 lakh.

But here's the fine print you should know:

When Rohan received his credit card statement, he noticed that interest had been charged, so he called his bank.

“I chose the NCEMI option. Why is there interest showing up?” he asked.

The banker explained:

“NCEMI means there’s no additional interest charged to you. But we’re a bank and we can’t lend money for free. So, for record purposes, the ₹1.2 lakh is split into ₹1 lakh principal and ₹20,000 interest. What we collect from you is ₹1.2 lakh only in total, so there’s no extra cost to you.”

The split is generally decided by the bank based on an interest rate of 15%-16% per annum.

But wait, that’s not the full story.

Costs in no-cost EMI

There are two charges under NCEMI that many people overlook:

An 18% GST on interest:

Did you know that only credit card interest is charged GST, and this is not applicable to any other loan?

In Rohan's case:

Interest in the credit card statement over 12 months = ₹20,000

So, GST = ₹20,000 × 18% = ₹3,600

Processing fee on EMI:

A one-time fee of ₹100 + 18% GST = ₹118

So in total, Rohan ended up paying:

₹1,20,000 (laptop cost under NCEMI after discount)

+ ₹3,600 (GST on interest)

+ ₹118 (processing fee plus GST)

= ₹1,23,718

Out of the original ₹8,000 discount, his net benefit was only around ₹4,282 (8000-3600-118).

As the tenure of the loan increases, the interest amount goes up, and so does the GST amount.

You have to make sure that the discount you receive is higher than the costs you pay, even in NCEMI options.

Always do the math yourself

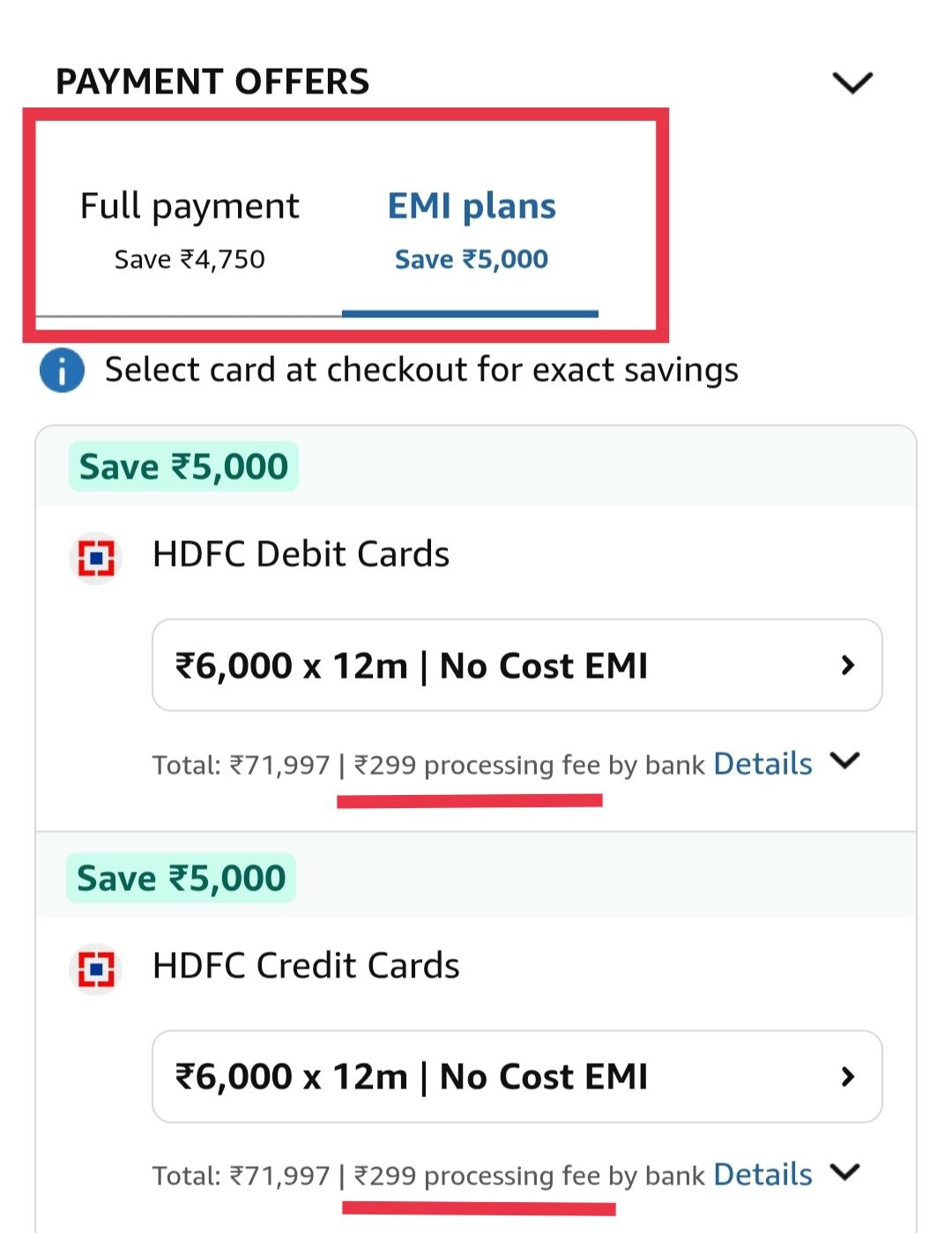

After Rohan’s scenario, I checked the price of a random OnePlus phone on Amazon just out of curiosity. For HDFC credit card holders, the no-cost EMI option for a 12-month tenure comes with a ₹5,000 discount.

After doing the math, I realized that the net discount was only around ₹3,500 once I accounted for GST on interest and processing fees. On the other hand, the upfront payment option offered a ₹4,750 discount.

So clearly, I’d be better off paying upfront.

The unfortunate part is that the amount you pay as interest and GST on these EMI options is not always clearly disclosed.

It’s up to you to do the calculations and see whether the discount actually makes sense.

Based on the information you have, you can use calculators to estimate the interest amount and calculate the GST you’d be required to pay.

The double-edged sword

When we talk about loans, it's impossible not to mention the pitfalls that come with them.

A quick scroll through e-commerce platforms reveals a trend: banks offer better discounts for longer EMI tenures of 12 to 18 months, compared to shorter tenures like 3 to 6 months.

This is because the risk of default increases with longer tenures. And if you do default, the interest rates jump drastically, often in the range of 24% to 36% per annum. Not just that, your credit score takes a hit.

No amount of upfront discount can compensate for the penalty interest and late fees you might end up paying.

We often tell ourselves, “I won’t default. I’ll pay on time.”

It may seem like a small amount today, but as you stack on more EMI purchases, it can snowball into something unmanageable.

Also, keep in mind that many EMI options come with foreclosure charges if you try to repay the loan early. And in some cases, the discounts you received at the time of purchase may also be revoked if you foreclose.

So, before choosing the EMI route, shop around. See if the upfront payment option offers a comparable or better deal.

As they say, "Debt is a double-edged sword." And in today’s world, it's only getting sharper on both ends.

So be aware and know what you're really paying for.

This newsletter has been put together by Satya Sontanam and Apurva Gururaj.

Did you read “India’s long shot with semiconductors” last week on Side Notes by Zerodha Varsity?

For any feedback or topic suggestions, write to us at varsity@zerodha.com.

Other than the issue with interest, there’s an important thing overlooked here. With an EMI we tend to purchase things that are not in our purchase capacity. First people make up their mind to purchase something that they can’t afford, then they justify that with the discount linked to only EMI purchases. Also as an Entrepreneur what I often notice is salaried people are the first to go through EMI route , not people with a business. The reason is simple, they tend to believe that whatever peanuts they are being offered at job is a guaranteed income.

As someone who got his first laptop on a NCEMI.

The biggest advantage is you can manage cashflows and don’t have to pay at once and emi does help you considering you are not in an immediate financial burden.

But yes, one should be mindful of how to manage it.

Or, do a RD of the respective amount and then buy the product, it may reduce the guilt of spending it, if you want to purchase a discretionary item or something you want but not immediately need.