Making sense of it all

Issue #11

Hello everyone, my name is Bhuvan and in this issue, we’ll look at how stories get us in trouble when trading and investing.

🧠 Innerworth — Mind over markets

This year has been a much-needed reminder that markets don’t always go up. Take a step back and think about how these volatile markets make you feel.

Doesn’t feel great, right?

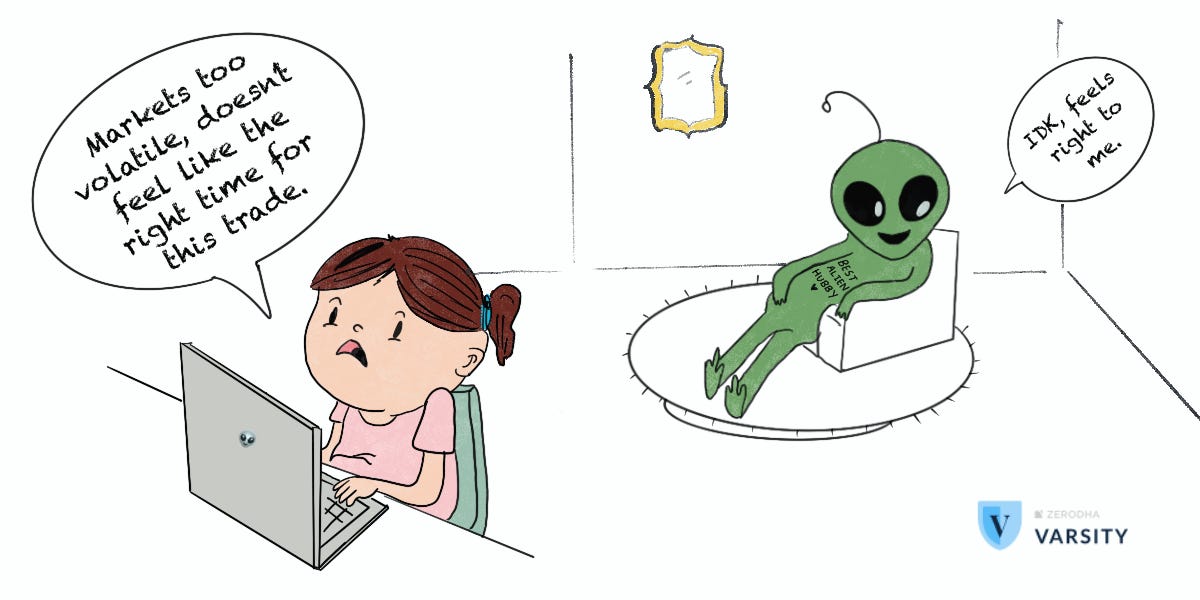

If it does, then you must an alien. But if you’re feeling uncomfortable, anxious, or even a little bit queasy, then you’re perfectly normal. Our brains hate uncertainty more than anything else. In fact, we hate the uncertainty of a bad outcome more than the bad outcome itself. There was a study that showed that people were more stressed when they had a 50% probability of getting an electric shock than knowing for sure they would get a shock.

This is how our brains have evolved over the centuries. Neuroscientist Lisa Feldman Barrett has shown that, contrary to popular perception, the function of the brain isn’t to think but to regulate energy usage to ensure our survival. When things are uncertain, the brain consumes more energy. In order to conserve energy, our brains evolved various mechanisms like pattern-seeking and storytelling.

Our brains are constantly bombarded with information, and they need to make sense of the deluge of stimuli. But processing everything is impossible because it would take far too much energy, and more importantly, it would also make our brains explode.

So, what do we do?

At any given point in time, we’re only processing a tiny amount of information. So our brains evolved to seek patterns in chaos and randomness. We look for patterns that we’re familiar with since this requires less energy. We process things that we know or understand and ignore those that we don’t. We arrange things in a way that helps us make sense of uncertain things, much like solving a puzzle. In doing so, we build stories and narratives that suit us, and we’re constantly doing this unconsciously.

So in a real sense, we’re making up our reality, one that may not necessarily be the same as that of other people. We’re not rational animals, but rationalizing animals.

We’re also hardwired to seek pleasure and avoid pain. When our stories, our patterns, and predictions are right, the reward system in our brain is activated. So being right is as good as getting a reward. So we unconsciously keep doing more things to have that rewarding feeling. This is why we’ll do anything to reduce uncertainty—because it feels good.

But this tendency is dangerous and is fundamentally incompatible with the markets. The stock market is a complex adaptive system. It’s the sum of millions of actors with different motivations, and time horizons, each acting on imperfect information. To even think that we can predict how such a system will perform is the height of foolishness, yet, investors and traders do it every single day.

Most traders and investors make decisions without any solid thesis based on what they think, feel, hear, or do what others are doing. In other words, they rely on shortcuts and patterns. This always ends in disaster.

Since the markets are inherently uncertain and complex, it’s almost impossible to predict them. How you think the markets will move and how they actually move will almost always be different. But yet most traders and investors buy and sell things under the assumption that their view is always right and that everyone else must be thinking in the same way.

Take the example of 2020. As soon as the markets crashed due to COVID-19, people became incredibly bearish. But soon, the markets rebounded spectacularly, even as COVID-19 cases were rising, and the economic damage was getting worse. Many remained bearish and short on the market. They were perplexed as to how could the markets go up when there was so much death and destruction. Sadly, most came to the conclusion that the markets were wrong instead of accepting they were wrong.

Our need for certainty is why we constantly crave explanations as to why the markets went up or down on any given day. Given our need for certainty, we make up all sorts of stories about why something happened to the markets or stocks after the fact.

Accepting the fact that short-term market movements are mostly random and that predicting market movements is hard, if not impossible, requires enormous humility. Most people don’t like being humble and accepting that they can’t explain something. But if you don’t make peace with this fact, the markets are really good at humbling people, even the best.

It can be granted right away that if you have been a brilliant decision-maker, over a long enough period of time, maybe that's who you are, and it won't hurt you to walk around feeling brilliant. But it is a dangerous procedure, for the market has a way of inducing humility in even its most successful students. - Adam Smith, The Money Game

Making money requires understanding this aspect and then focussing on what you can control and ignoring things you can’t.

The need to focus on process rather than outcomes is critical in investing. Focusing on process frees us up from worrying about aspects of investment which we really can't control - such as return. By focusing upon process we maximise our potential to generate good long-term returns. - James Montier

You need to develop tools and strategies that maximise the odds in your favour. This is why I’m personally a fan of trend and momentum-based strategies because they don’t care about the markets or don’t rely on subjective judgments. Simply put, trend and momentum are just buying things that are going up and selling things that go down. That doesn’t mean it’s all sunshine and roses. These strategies are nightmarishly hard to stick with and can frustrate you for long periods of time. I like them because these strategies ensure that you are always with the market trend and not against it. Despite the simplicity, these strategies haven’t been arbitraged away, and they still work as they have for centuries. This also shows you that knowing is easy while doing is nightmarishly hard.

If you’re relying on your gut rather than a rule-based approach to investing, you can be almost certain that your feelings of risk or safety are exactly the opposite of what they ought to be. - Daniel Crosby

This week’s Innerworth article stuck a chord with me. It’s a short piece that beautifully explains we make monumentally dumb mistakes when trading and investing.

How can we defeat the false consensus effect? The best defense is to gain awareness of it. Remind yourself that you are acting on imperfect information. You must accept this fact of trading, but you can work around it. Always be a little skeptical. Manage risk and be ready to accept the fact that you may be wrong. You’re human, after all, and you are prone to make biased decisions occasionally. Rather than beat yourself up, it’s better to take it in stride and move on.

📺 Varsity video series

Whenever there is some volatility in the market, investors and traders get spooked and make all sorts of avoidable mistakes. None of these mistakes are a secret or a mystery, we all know them, yet we make them. It goes to show the importance of controlling your emotions when trading and investing. In this video, Karthik explains the most common mistakes that mutual fund investors, equity investors, and traders make during bear markets and most importantly how to avoid them.

❔ On Tradingqna

We wrote a post on the TradingQnA newsletter looking at some data points on how India has changed in the last 75 years.

🐦 On Twitter

A few things we shared on Twitter

🎙️ Zerodha Educate

On the Zerodha Educate podcast, we caught up with Sankaran Naren, the CIO of ICICI Prudential AMC. In this conversation, we talk at length about contrarian investing, central banks, asset allocation, the current market cycle, and much more.

That’s all for this issue, and thank you for reading. Please do share and spread the word If you liked this issue.

Follow us on @zerodhavarsity for more updates.

What did you think about this issue of the newsletter? We’d love to hear your thought, please leave a comment.

Hey Bhuvan,

Like mentioned and said that we can't predict market, but all these techniques and strategies they might also not be so great as the market will move on its own term. Do, we have to be felixible in our trading strategies and move in the way market is moving? Also, there are various situations where due to some events markets have moved in a certain direction, so at that point do we have to rely on the events for the market fluctuations or was the market working in its own term and the events didn't have anything to do at all?