How to check unclaimed deposits, shares & MFs

A simple guide to find the forgotten investments of you and your family.

There are two kinds of money in India.

The first is the money we possess. We are protective of it. We bargain even with small vegetable vendors to save that extra ₹10 on a few kilos of onions. This is the kind of money we plan for how to use it, how to spend it, and how to save it for the future.

And then there is the second kind, money that is completely forgotten, sitting idle in lockers or accounts. Money that we, or our family members, worked hard to earn, and which is waiting to get back to its rightful owners.

I am talking about unclaimed investments - the unclaimed bank deposits, mutual funds, shares, and dividends.

The unclaimed money issue is so large that it becomes a point of debate in the parliaments. In July 2025, the Ministry of Finance confirmed that ₹67,000 crore is the cumulative amount unclaimed with both public and private sector banks.

Regarding mutual funds, the unclaimed dividends and redemption (sale) proceeds, according to SEBI’s Annual Report for FY 2024–25, were around ₹3,500 crore.

Now, about the forgotten shares. According to the official numbers, as of 31 December 2023, there were over 1.4 billion unclaimed shares worth about ₹ 65,000 crore and unclaimed dividends worth around ₹6,000 crore.

Let’s not even talk about the whopping amount of money neglected in the post office schemes, EPFO (Employees’ Provident Fund Organization), and the amount unclaimed from insurance companies after a family member’s death.

Altogether, across banks, mutual funds, shares, insurance, post office and EPF, the unclaimed amount is estimated to be around ₹1.8 lakh crore.

To give you a perspective on what this amount means, say, we invested this in a savings account earning just 4% per annum. Every day there’s a sunrise, it would earn about ₹20 crore in interest alone.

That is the state of unclaimed money in India. And while the authorities, such as the Finance Ministry, RBI, and SEBI, have started taking steps, there is still a long way to go.

In this week’s Second Order newsletter, I will talk about the platforms where you can check these unclaimed investments. Note that this is just for searching; we will probably do another story on how to claim them.

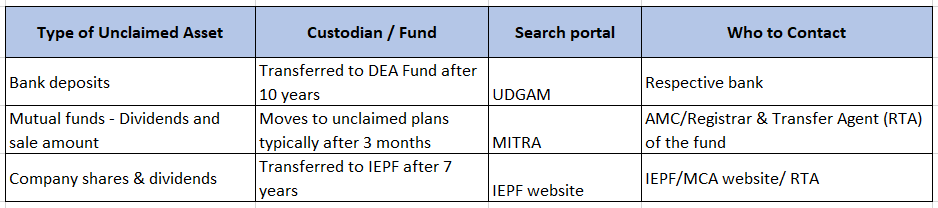

Unclaimed bank deposits

Unclaimed deposits are the amounts lying in bank accounts that have not been operated or claimed for a long period. These are typically of two kinds:

Savings or current accounts that have not been operated for 10 years

Term deposits that have not been claimed within 10 years from the maturity date, unless they are auto-renewed.

After 10 years, banks are required to transfer the balances from such accounts to the Depositor Education and Awareness (DEA) Fund, maintained by the Reserve Bank of India (RBI). The money still belongs to the account holder or their nominee, and it can be claimed at any time by contacting the respective bank.

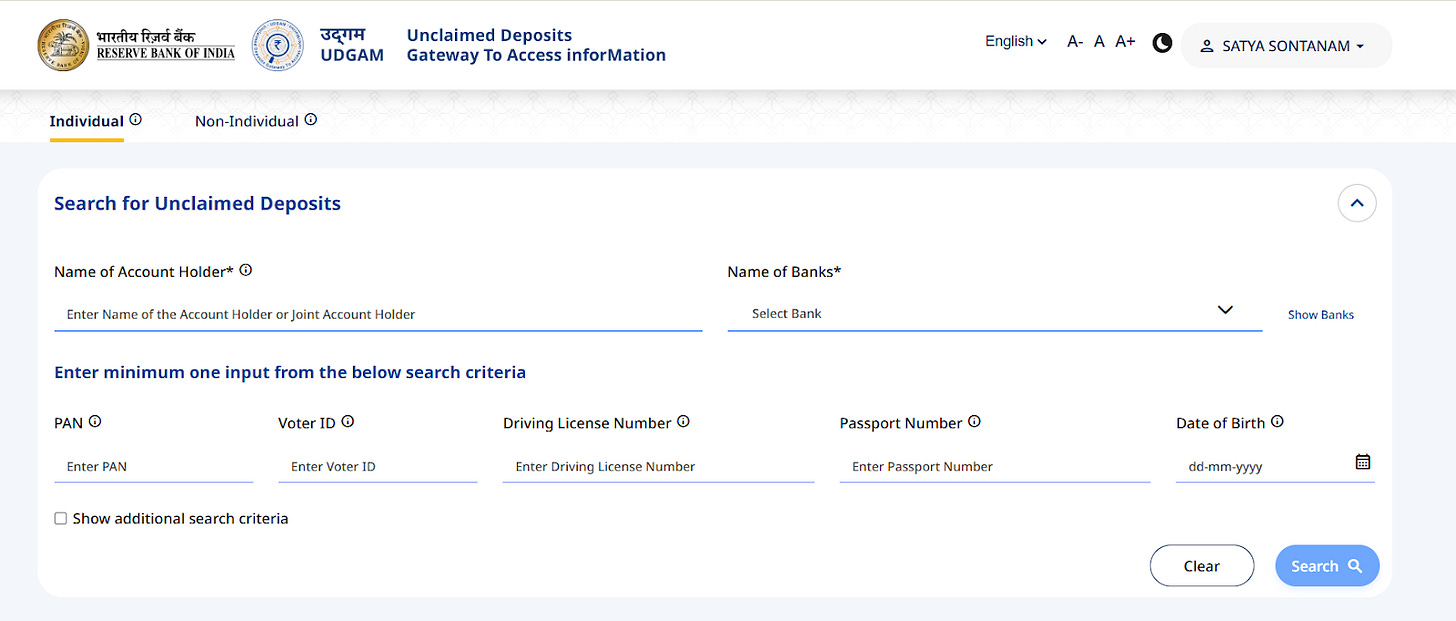

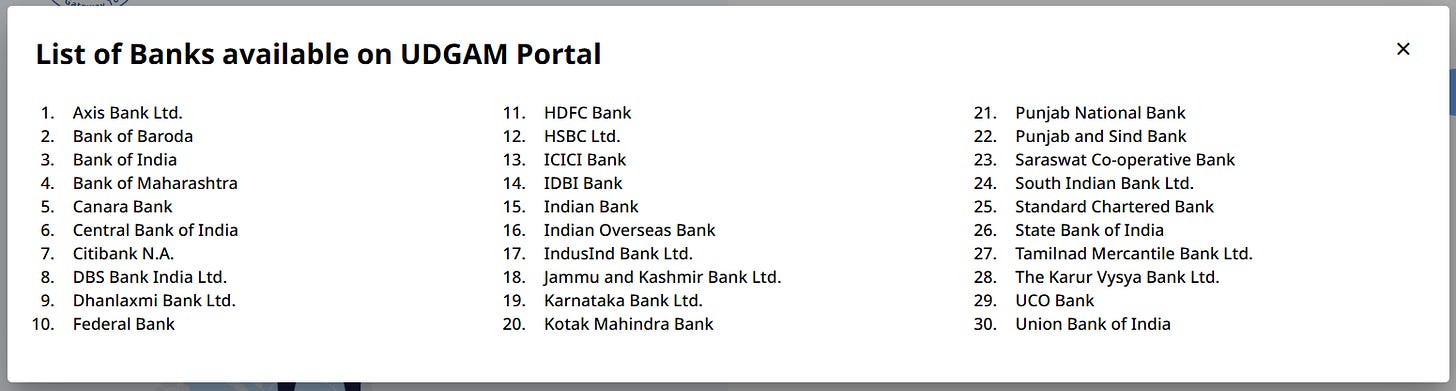

To help people trace these forgotten deposits, the RBI has launched the UDGAM (Unclaimed Deposits – Gateway to Access Information) platform. Once you log in, you’ll need to provide the name of the account holder, the bank name, and any one identification detail such as PAN, voter ID, driving license, passport, or date of birth.

Currently, the UDGAM platform displays unclaimed deposits from 30 banks.

A problem you might face while using the UDGAM platform is that sometimes the OTP takes time to arrive. You have to keep trying again. Also, you cannot claim the amount directly on the platform. Once you have found the unclaimed deposit details, you must reach out to the concerned bank and start the claim process or make it operative again.

Pro tip: If you do not know the name of the bank where deposits are held, select all banks instead of choosing an individual bank.

Unclaimed mutual funds

Unclaimed amounts in mutual funds refer to money that is due to investors but remains with the fund houses because the redemption or IDCW (dividend) proceeds were not successfully credited to the investor’s bank account.

This can happen for various reasons, like incomplete or incorrect bank details, a change in address, or simply because the investor forgot to deposit or encash the redemption or dividend cheque. When such payments remain unpaid for more than 90 days, typically, the AMC transfers these proceeds into separate ‘unclaimed’ plans.

These plans sound like this:

Invesco India Liquid Fund – Unclaimed Redemption – Above 3 Years

Invesco India Liquid Fund – Unclaimed Dividend – Below 3 Years

These are specific schemes where AMCs park unclaimed investor amounts and invest them in liquid, low-risk instruments. The investor (or their nominee) can claim this money anytime by reaching out to the AMC.

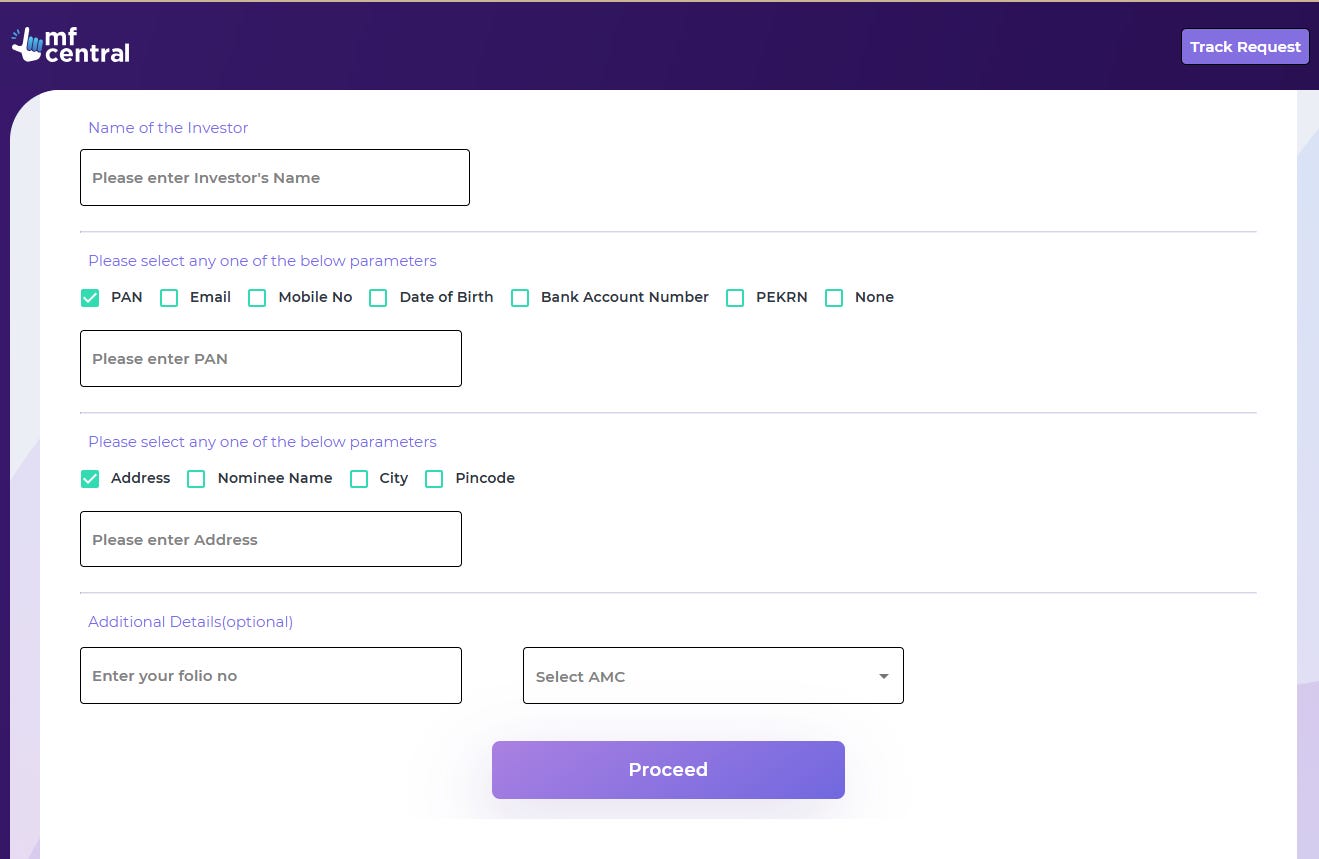

To make it easier to trace these unclaimed investments, SEBI has introduced the MITRA (Mutual Fund Investment Tracing and Retrieval Assistant) platform. All you need is your PAN, registered email or phone number, and your address to use this portal and check for unclaimed mutual fund investments linked to your details.

Note that there’s a daily limit on the number of searches. Even unsuccessful attempts are counted.

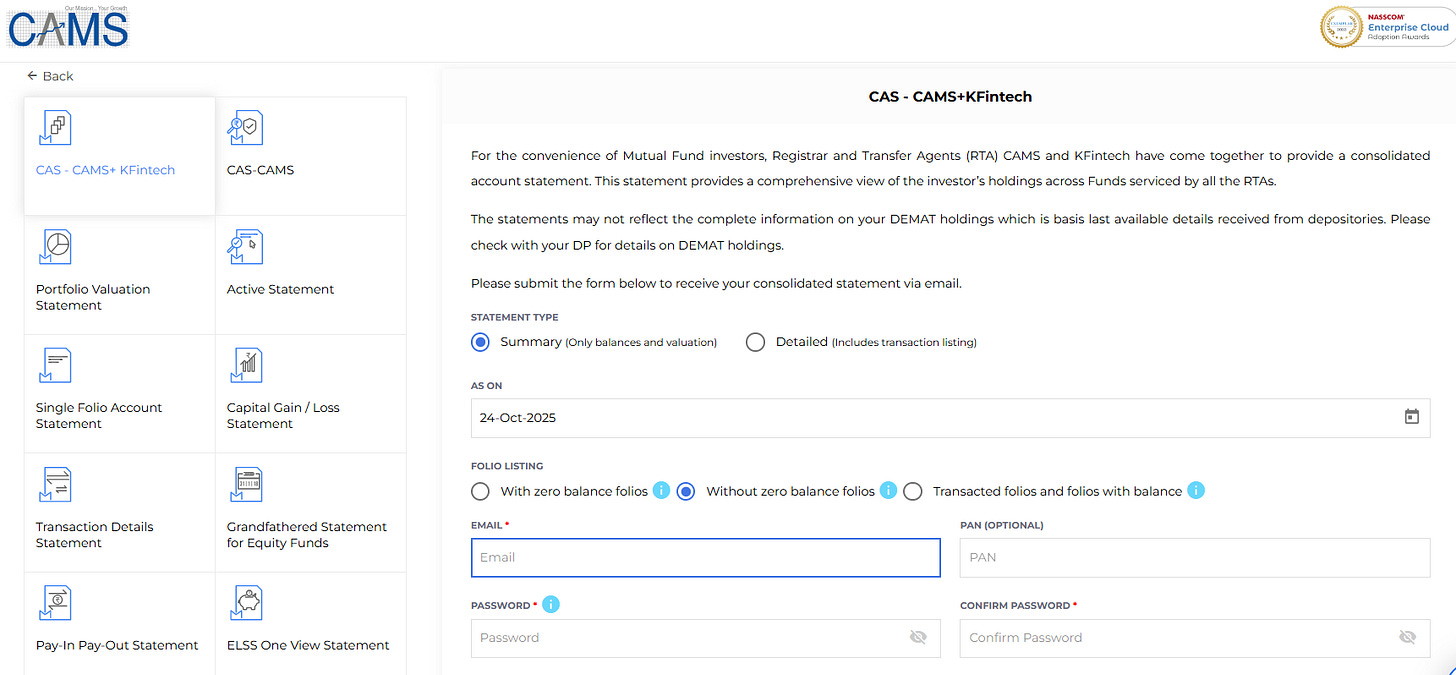

An alternative way to search for inactive or forgotten mutual fund investments is through Registrar and Transfer Agent (RTA) platforms such as CAMS or KFintech, which allow you to generate a Consolidated Account Statement (CAS). This statement shows all mutual fund investments linked to a specific PAN across all RTAs, not just one.

However, there are some challenges. For very old mutual funds that may have been merged or acquired by another AMC, you might not find the details immediately. This is based on personal experience. In such cases, it’s best to contact the RTA or the successor AMC directly to locate and verify any investments in your name or that of a deceased family member.

Unclaimed shares and dividends

Now comes the trickiest part—unclaimed shares and dividends. Be prepared to be patient, as even the search process can take time.

When an investor doesn’t claim their dividend for seven consecutive years, the company transfers both the unclaimed dividend amount and the underlying shares to the Investor Education and Protection Fund (IEPF), which is managed by the Ministry of Corporate Affairs (MCA). Your ownership doesn’t go away, but claiming it back requires some effort and documentation.

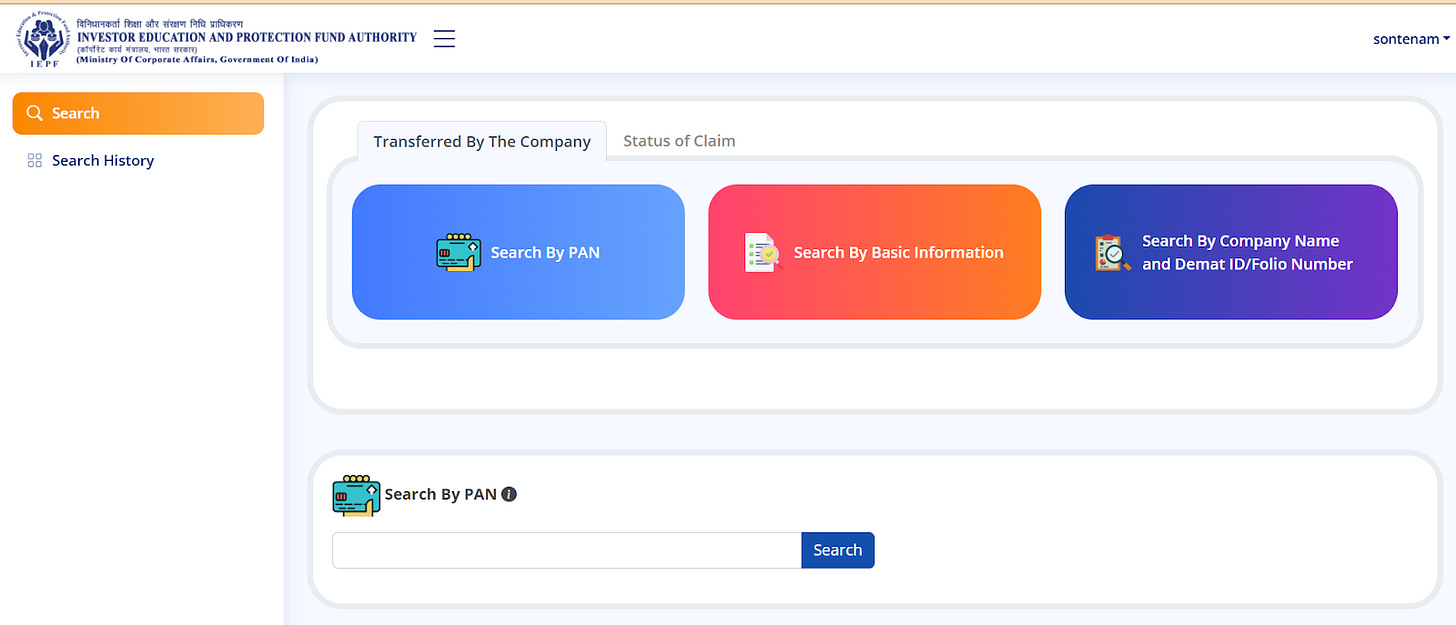

To search for such unclaimed shares and dividends, you need to create an account on the IEPF website. You’ll need the name, PAN, email ID, and mobile number to register. Once your account is set up, you can search using different criteria — by name, PAN, or if you know the company name, you can use the demat number (for dematerialized shares) or the folio number (for physical shares).

You might face a few problems along the way while using the IEPF portal. For example, if your name appears differently across records (like first name, middle name, or last name in a different order), the search might not return results. Try different combinations. And even then, sometimes the details may not appear at all. Besides, there is a restriction on the number of times you can search in a day.

Alternatively, if you know the company name, you can check its website. Listed companies publish lists of unclaimed dividends or shares transferred to IEPF, either year-wise or cumulatively. Reaching out to the company’s Registrar and Transfer Agent (RTA) directly is often the easiest way to get the details.

If finding the unclaimed shares and dividends is this difficult, claiming them from IEPF is generally considered even more time-consuming. So it’s wise to be prepared for a patient process.

Final word

The Ministry of Finance is exploring different ways to make searching for and accessing unclaimed investments easier. The intent is clear, and we may see further developments in the coming years, hopefully an integrated platform that lets us search everything in one place. But for now, this is the process for looking for details across banks, mutual funds, and shares.

Do note that the search process itself can be a bit tiring, and that’s when the investor is around and has access to their own details and devices. If an investor passes away, the process can become even more complicated.

As a final note, please make sure you have written a will and added nominations wherever possible. While this may not seem directly linked, it makes a world of difference for those who have to trace these investments after we are gone.

This Newsletter was written by Satya Sontanam.

Do read Why did Reliance Jio need money when it already had enough? newsletter on our Side Notes by Zerodha Varsity.

For any feedback or topic suggestions, write to us at varsity@zerodha.com.

Great effort

This is super helpful stuff that people often overlook. The example with Invesco India Liquid Fund unclaimed redemptions and dividends really shows how easy it is to lose track of low friction assets like liquid funds. I've seen family members have forgotten MF holdings exactly like this when they switch brokers or change email addresses. The fact that there's over Rs 100,000 crores sitting unclaimed across all instruments is wild. One question though, for somone who's checking multiple family members accounts, is there a way to batch search or do you have to go through each person's PAN individualy? The step by step guide with the screenshots made it pretty straightforwrd to follow. Thanks for putting this together.