How much should you save for your child’s education?

School fees in India: takeaways from a recent survey

A recent post on social media about school fees in Bangalore went viral. No surprise at the reaction it garnered, as the sheer costs are enough to stop you in your tracks.

This is about one of the top-tier schools in the city that is charging an annual fee of ₹7.35 lakh for Grades 1 to 5, ₹7.75 lakh for Grades 6 to 8, ₹8.5 lakh for Grades 9 and 10, and ₹11 lakh each for 11th and 12th — adding up to nearly a crore for the entire school education of one child. That’s assuming inflation doesn’t double the school fees by the time the child reaches high school.

It’s for an IB MVP (International Baccalaureate Middle Years Programme) curriculum that focuses on niche/global knowledge and requires more specialized teachers and resources.

But posts like these don’t tell you beyond what the costliest schools charge. So, let’s quickly get to the ground reality.

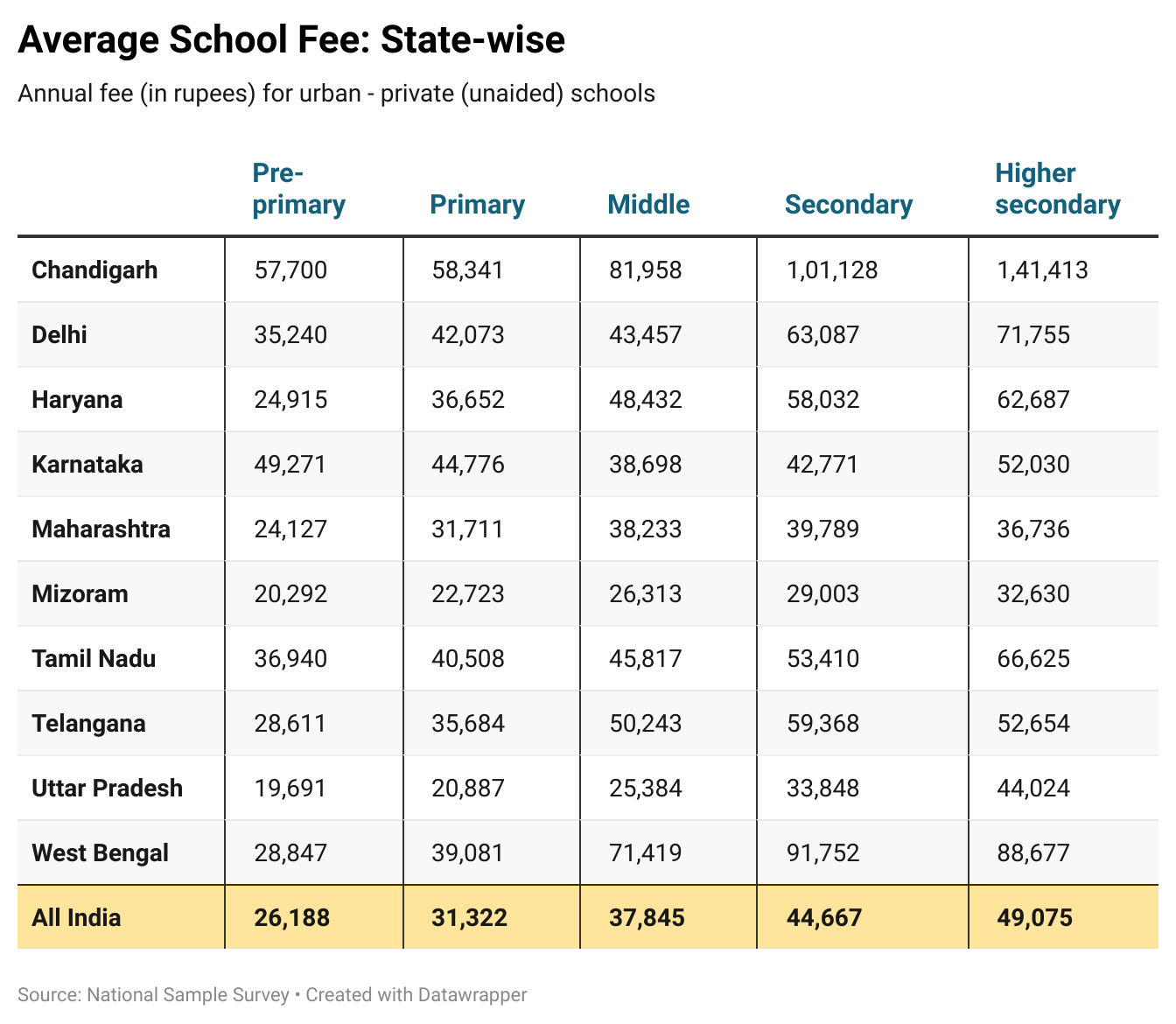

The National Sample Survey (NSS) recently released a report on the average cost of education in India. I looked at the numbers for urban private schools, and this is what the table says for some states.

For many parents, especially those in tier-1 cities, these figures may look too low. But remember, these are averages.

From this table, let’s estimate the costs for a reputed private school in a tier-1 city. And by ‘reputed,’ I mean not the high-end luxurious type but the kind of school that parents look up to. They generally come at a premium over the state’s average school fees.

Take Karnataka. Any reputed private school in Bangalore charges about ₹1.2–1.5 lakh a year for pre-primary grades. So, using a ‘3x’ multiplier on the NSS average (₹49,271 from the table above) brings us close to the actual costs of such schools in the city.

Going by that 3x multiple on NSS data, the school fee from Grade 1 to 12 totals around ₹16 lakh per child in Bangalore, Karnataka (compared to the astonishing ₹1 crore number that a high-end school charges).

On the other hand, in Chandigarh, one of the costliest cities for school education in India as per the NSS data, a similar school could cost almost double, around ₹30 lakh per child.

And that’s just the school fee. Once you add transportation, uniforms, stationery, and extracurriculars (say ₹50,000 per year per child) and a 10% inflation, the same amount quickly climbs to ₹24–₹40 lakh for one child’s entire school education in Bangalore and Chandigarh, respectively.

This has to be spent over 12 years of the child’s schooling.

If you’re not in a tier-1 city, a ‘2x’ multiplier might be more realistic. That works out to about ₹18 lakh in Karnataka per child from Grade 1 to 12 (after adjusting for inflation).

Now, are these numbers high or reasonable? It depends entirely on every family’s income. But one thing is certain. They don’t look reasonable when you compare them with what your parents paid for your schooling. We are not playing the same game.

Times have changed. Comparing across generations is not apples to apples. The ‘above-average’ school back then would be seen as just a basic school today, and a premium school now is in a different league altogether.

That’s not to say education costs haven’t gone up. Historically, inflation in medical and education expenses has outpaced general inflation, which hovered around 6%. While there’s no official number, anecdotal evidence suggests education costs (at the same level of quality) have risen closer to 10% annually.

If you’re a parent of a child in a primary school, it’s safe to assume at least a 15% increase every year from the current costs. That accounts for both the inflation and the markup in fees as children progress to higher grades.

This is just to give you a ballpark sense of what current education costs in India look like. Of course, it also depends on the board you choose — State board, CBSE, ICSE, or global ones like MVP. I gave an example for Bangalore and Chandigarh, but you can run the same math for different states/UTs using the NSS base numbers.

Financing the school fee

“School fees for children are best treated as a matter of managing cash flows rather than dipping into long-term investments,” said Vishal Dhawan, a registered investment advisor.

We contacted Vishal to understand how parents view school fees and how he suggests they plan for them.

School fees, once they begin, become a recurring outflow for the next 12–15 years. The rise in costs is also fairly predictable from current levels. So, the smarter way to handle them is through cash flows, i.e., income (like salary), which generally increases every year as well.

Vishal also shared a common thread he hears from his clients. They say, “I want to spend as much as I can for my child’s education,” and often prioritize school expenses over their retirement savings, even dipping into existing investments.

That instinct is natural — it’s in our DNA to want to go beyond and give our kids the best.

For young parents who haven’t yet built large portfolios, dipping into investments is rarely sustainable. School fees are not a one-time cost. They come around every year and grow steadily with inflation.

Also, Vishal stresses the importance of looking at school fees holistically. The same wallet also has to cover family vacations, a car upgrade, emergencies, and retirement planning.

While there is no strict thumb rule, his experience suggests that once parents spend more than 10% of their household income on school fees, the squeeze begins to show elsewhere. It could mean skipping a holiday, leaving the emergency fund short, or postponing personal goals. These trade-offs must be thought through carefully.

Beyond schooling

As we just saw, schooling can usually be managed with incoming cashflows — your salary. But higher education is a different beast. It demands planning much earlier and in much bigger numbers.

If you’re the parent of a young child, sitting here today, can you really imagine what they’ll want to do 15 years from now? Engineering or economics? Medicine or media? Studying in India or heading abroad? The possibilities are endless, and that’s exactly what makes this part of the puzzle tricky.

I asked Vishal how he handles this uncertainty when parents come to him.

“If a parent is looking to fund higher education, including 3–4 years of undergrad and 2 years of postgrad — we’re talking about financing 5–6 years of education. Planning for ₹10–15 lakh a year (in today’s value) gives you a wide enough range to work with. It may not cover a full international degree, but it sets a good foundation. This is considering that admission to lower-cost colleges isn’t always in your control. Thus, as a bare minimum, we recommend working with at least ₹10 lakh a year.”

Do the math and you’ll see why planning early matters. If you have 15 years before your child heads to college, and you’re targeting ₹10 lakh a year for 5 years, that’s ₹1.5 crore in future value (after adjusting for an inflation of 7%).

To reach that number, you’d need to start a SIP of about ₹30,000 per month today. And remember, this is apart from school fees.

Just knowing this amount makes us more grounded in our choices about how much to stretch for early schooling. This is what Vishal meant by a holistic view.

There’s another angle too. Many parents now consciously leave postgrad expenses to the child, encouraging them to take an education loan they’ll repay once they start working. It reduces the parents’ burden and builds accountability for the child.

But Vishal cautions parents not to let their guard down completely: “What if your child struggles to find a job right after postgrad, or decides to wait for a better role? During such times, parents usually become the backup option.”

In the end, it really is as the old proverb says: “It takes a village to raise a child.”

Raising a child may be priceless, but financing their education definitely has a price tag, and the earlier you know it, the better.

This Newsletter was written by Satya Sontanam.

Do read Liquid soaps - a frothier business than bar soaps newsletter on our Side Notes by Zerodha Varsity.

For any feedback or topic suggestions, write to us at varsity@zerodha.com.

Insightful commentary. However, the cost of education being charged by schools has now reached insane levels. They exploit the emotional vulnerability of parents, who hesitate to compromise when it comes to their children. Schools are fast transforming into five-star facility centers, more about status symbols than learning. In this rat race, the true purpose and meaning of education is quietly slipping into the background.

This breakdown was super useful. Most viral posts only highlight the extreme cases, but the way you’ve layered NSS data with realistic multipliers for reputed schools gives a much clearer picture. The point on treating school fees as a cash flow expense vs dipping into investments really struck a chord — it’s a practical lens that many parents overlook while focusing only on “giving the best.” The contrast between managing school fees and planning early for higher education is also an eye-opener. Thanks for putting numbers to something every parent worries about but rarely calculates!