Does higher risk guarantee higher return?

A closer look at risk—why taking bigger risks doesn’t always mean bigger rewards and how time helps manage uncertainty.

It was 1967. Howard Marks, the man known today for his brilliant investment memos was in college.

The place? The University of Chicago Graduate School of Business. The topic? The relationship between risk and return.

There was a graph that students were shown all the time.

It’s a very simple graph showing that as the risk goes up, the return also goes up.

Everybody in the college used to say, "The way to make more money is to take more risks.”

But Howard was never happy with it.

“If riskier assets always give higher returns, then why are they risky?” he thought.

His point was that just because we take a risk doesn’t mean we’ll be rewarded all the time. That’s not how risk works.

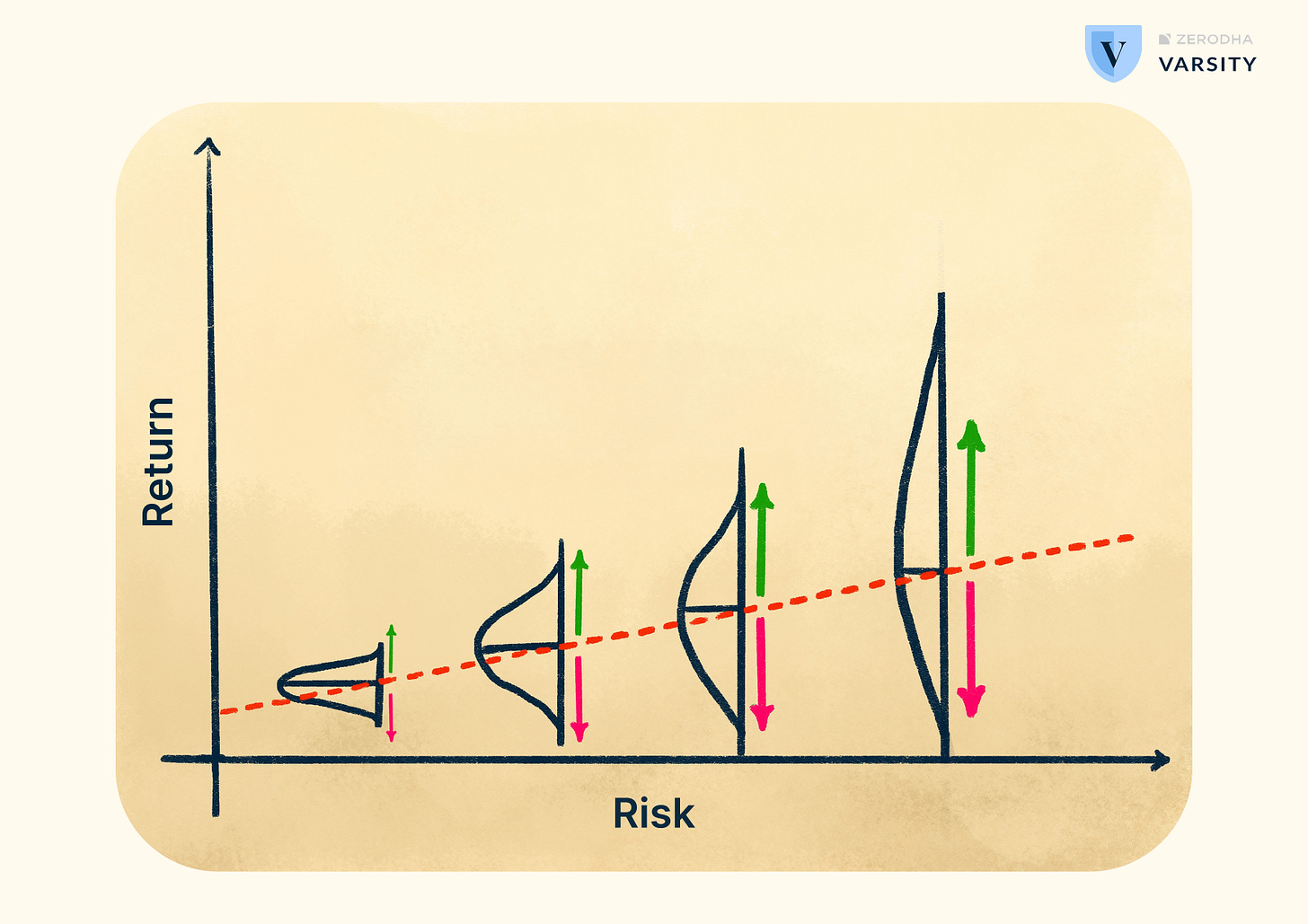

So, Howard created his own version of the chart. It looked something like this-

In this new chart, you see that a few vertical lines were introduced within the existing graph. These lines represent the ‘range of return possibilities’ at different stages of risk.

As the risk increases, the range of possible outcomes also widens. The best-case scenario improves, but the worst-case scenario becomes much worse.

“This is the risk. This is how to think about the relationship between risk and return,” Howard said.

Let’s check some real data?

I wanted to test this idea by looking at about 20 years of Indian market data. (That's the cool part of my job 🙂)

I picked something we’re all familiar with: large, mid, and small-cap investments. The smaller the companies invested in, the higher the risk.

From 2005 to the end of 2024, I checked every possible five-year investing period. That gave me about 3,600 periods.

Take any five-year period from this dataset, and my return could have been anywhere from -0.3% to 25% p.a, had I invested in a large-cap index fund.

And if you are wondering if a return can be negative even after holding for five years, yes, it could! That’s the risk that equity investing comes with.

In the past, anyone invested at the peak of 2007/2008 would have seen sober returns even after holding the money for about five years.

Anyway, moving on, had I invested in a small-cap index fund with a higher risk, my return possibilities would have widened a lot—to anywhere between -6 % and 34% p.a. The upside is higher, but so is the potential to lose.

If I could ask Howard Marks whether risks should be avoided, he’d say:

"Risk is something to be managed and controlled, not avoided."

And in equity investing, ‘time’ is the only thing in our control to manage.

Had I invested in small caps for just one year, my returns could have ranged from -70% to 175%, extremely volatile (see the image above).

But, over a 10-year period, that range would have narrowed significantly to 3% to 22% p.a.

This way of looking at risk has become my favourite perspective. We also made a short video about this. Hope this gives you some food for thought this weekend! 😊

- Satya Sontanam

The better we understand ourselves, the better our financial decisions will be.

What are Index Funds?

Imagine you have a big jar of candy, and each piece of candy represents a company. An index fund is like a giant scoop that grabs a little bit of every type of candy in the jar instead of just picking a few.

Some people try to pick only the best candies (or companies) to make more money, but that’s tricky and takes a lot of expertise or guessing. Instead, an index fund just grabs a mix of everything, so if some candies (companies) aren’t great, others will still be yummy (successful) and balance things out.

This way, your candy collection (investment) grows over time without you having to worry about picking the perfect ones! 😊

Indian stock markets crashed on February 28 due to fears of a global trade war, weak Asian markets, and concerns about the U.S. economy.

Sensex fell 1,414 points (1.9%), and Nifty dropped 420 points (1.86%), wiping out ₹8.8 lakh crore in market value.

Trump’s tariff hikes on China, Canada, and Mexico fueled uncertainty.

Weak Asian markets and Nvidia’s disappointing forecast added to the pressure.

U.S. jobless claims rose, raising fears of an economic slowdown.

Do you want to meet team Varsity and everyone Zerodha? Yes, that includes Nithin Kamath, Nikhil Kamath, and Karthik Rangappa, too. Well, you can catch all of us, and it's free, but you will have to earn your pass. Check out Zero1 for more.