Dear Reader,

Imagine this - a Bear cartel decides to target a company’s stock and hammer down its share price. The company's promoter, instead of feeling threatened and vulnerable, decides to fight back and crush the bears.

He dials all his trustworthy friends from around the world for help. These friends step in and buy the stock. The collective buying not only arrests the fall in stock price, but also squeezes the bears.

This is not fiction. It is an actual story that happened in India in the 1980s, and to this day, it remains one of the most fascinating stories in the Indian stock markets.

By the way, you can also listen to this story here.

Time - Kolkata, 1980s

Back in the day, Kolkata had a very vibrant stock exchange, and a bulk of the trading activity was carried out in the Kolkata stock exchange.

During the 1980s, a cartel of Kolkata-based brokers was short-selling Reliance Industries stock in hoards.

At that time, Reliance had raised a lot of capital by selling convertible debentures. Debentures are basically borrowings from the public. If you invested in a 5-year debenture of Reliance, you would get interest payments for the five years and all your money back at the end of five years. But if it were a convertible debenture, you would have the option of not taking the money and instead converting it into equity.

But at what price of equity will you convert it?

Without getting too technical, let’s say you held a convertible debenture of Reliance Industries worth 10,000 rupees. At that time, one share of Reliance Industries was trading at around 125.

Simple math suggests that you should get 80 equity shares of 125 rupees to equal the value of the debenture worth 10000.

So if one Reliance share were trading at 200 rupees, you would get only 50 shares. And if it were trading at 100 rupees, you would get 100 shares.

The Kolkata-based cartel wanted a lower share price to obtain more shares per debenture. Therefore, they were short-selling the shares.

Short-selling is when you sell shares that you don’t have or own. Let’s say a short seller sells the shares at 100 first, and then at the time of delivery, buys the same shares from the market at 80. The 20-rupee difference is their gain.

But what if the market price goes up to 120 at the time of delivery? The short-seller will have to buy at the higher price, too, taking a loss of 20.

The Kolkata-based brokers were working as a cartel. Everyone was short-selling Reliance shares.

Note that this was in the 1980s, when all trades were settled only on alternate Fridays. You could sell today and figure out a way of delivering the shares until the next settlement Friday. So there was scope to short-sell. So much selling pressure from the cartel pushed the price from 131 to 121 in a day.

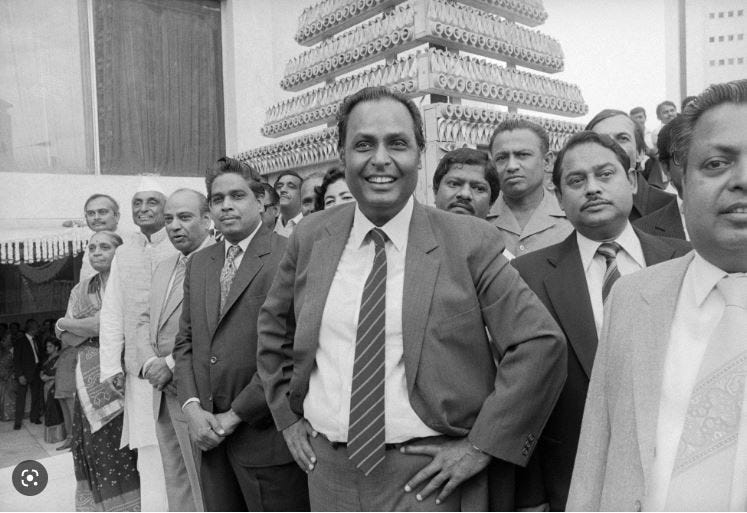

The bear cartel was happy with the price drop, and of course, Dhirubhai Ambani was not.

Plot twist : Undha Badla

Some NRI traders started buying the Reliance shares that the cartel had been shorting, helping steady the stock price.

When the next settlement Friday came, the NRI traders were ready with the funds for their purchases, but the bear cartel did not have the shares to deliver on the settlement day. So, they requested an Undha Badla, the system of rolling over the contract settlement to the next settlement day.

The cartel could pay a small fee to be allowed to settle the trade on the next settlement Friday. The NRI traders knew they had cornered the cartel. They asked the cartel to pay a fee of Rs. 25 per share.

Paying up would mean that the share price would have to further fall by more than 25 rupees for the trade to be profitable for them. They refused to pay. The resultant dispute halted all trading on BSE for three days.

Finally, the bear cartel started buying the Reliance shares to settle the trade. The cartel was big enough to push the share price to an all-time high of 201. The NRIs who had bought the shares at around 120-130 ended up with huge profits.

They saved Reliance shares from collapsing, took it to new heights, and pocketed a sweet profit. That’s why they came to be known as the Friends of Reliance. It was natural then to assume that Mr. Ambani got those NRIs to fight for him. Nothing was proven, though.

While this is a great story of grit and chutzpah, acting in cartels is illegal in all respects. Not just the brokers were a cartel, the NRIs who acted together were also a cartel. If you are found to be part of a cartel, you could be charged with facilitating a pump-and-dump scheme at the expense of the public.

What an interesting tale right? Knowing about it definitely feels good, but it is far removed from today’s reality. That’s it for today from Varisty HQ. See you all with another interesting story soon.

This newsletter has been put together by Apurva Gururaj and Vineet Rajani. If you have any feedback for us or something you’d like for us to cover in the upcoming newsletters, do let us know. Mail us at varsity@zerodha.com

Amazing story

Thank you Zerodha team

Interesting!!