Coke, compound interest & 4 Buffett gems to live by

1977 - 2024: Four favourite lessons from Buffett’s letters to shareholders.

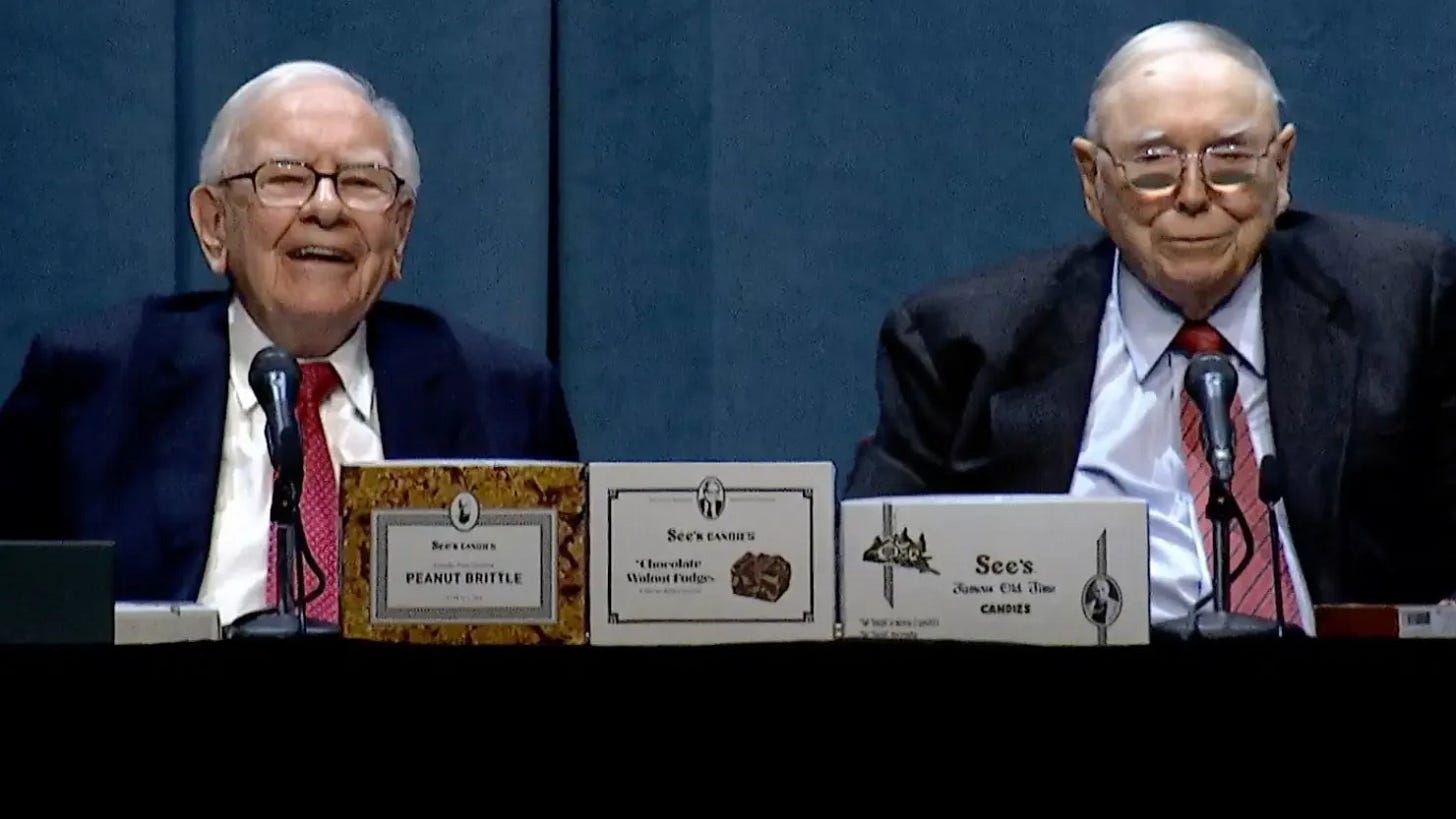

Last Saturday, Warren Buffett, at the age of 94, announced that he would step down as CEO of Berkshire Hathaway by the end of this year. His long-time colleague, Greg Abel, 62, will take over the reins.

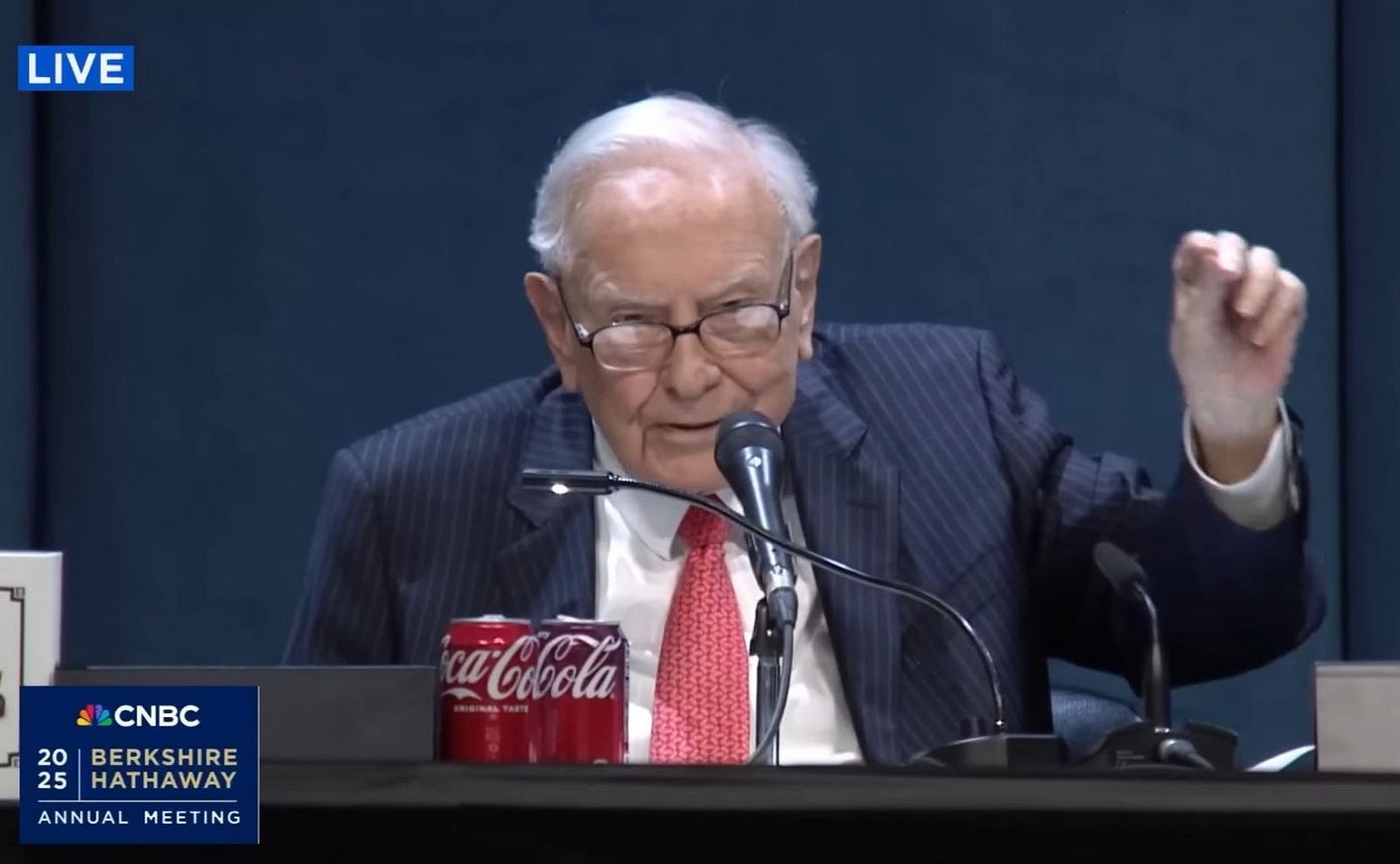

As Buffett shared the news, thunderous applause burst from almost 20,000 people in the auditorium who attended yet another Berkshire annual general meeting. Buffett, waiting for the applause to settle, smiled and joked, “Drink your Coke and calm down.”

Bill Gates, who is usually seated in the front row in every Berkshire AGM, choked up at the audience’s response.

Why am I narrating what may seem like just another change in corporate leadership? Because this moment is not just another.

Even if you’ve never invested a rupee or opened a finance textbook, chances are you’ve heard the name Warren Buffett.

On the other hand, those who follow him seek different things—a few admire his stock-picking skills, a few go further and replicate his investment portfolios, and finance writers like us use his quotes wherever possible to make our point even stronger.

With Warren Buffett stepping down, 2025 may mark the final year of his iconic shareholder letters, written in his own words.

So, today, I want to share our four favourite Buffett philosophies, which we've chosen from his shareholder letters from 1965 to 2025.

“My wealth has come from a combination of living in America, lucky genes and compound interest.”

While the first two are out of our control, the last one, compound interest, is very much in our hands.

The moment you start reading about Buffett’s childhood, you realise something quickly: he wanted to be rich. And soon enough, at the age of 10, he discovered the power of compounding. He often called it the eighth wonder of the world.

Compounding reveals its magic only when given enough time.

Morgan Housel, author of The Psychology of Money, said: “His (Buffett’s) skill is investing, but his secret is time.”

“If Buffett had retired at 65, you would have never heard of him,” he said in a CNBC interview. Housel points out that 99% of Buffett’s wealth came after the age of 65. Today, Buffett is one of the top ten richest people globally.

Buffett, too, often said that success in investing doesn’t come from being the smartest but from being disciplined and holding them for the long term:

“If you can’t hold a stock for 10 years, don’t even think about holding it for 10 minutes.”

This long-term approach towards investing may sound cliché, but the value of it hits you only when you live through it.

“The know-nothing investor can outperform many investment professionals.”

For all the fanfare around Buffett’s stock picks, he has always been clear on one thing: most people shouldn’t be picking stocks. In fact, he thinks most of us shouldn't even try to beat the market.

He suggests investing in a simple, low-cost S&P 500 index fund (the US equivalent of Nifty 500 in India) and letting it sit.

Back in 2007, he decided to prove his point. Buffett placed a $1 million bet that an S&P 500 index fund would outperform a bunch of handpicked, high-fee hedge funds (“an elite crew, loaded with brains, adrenaline and confidence”).

And guess what? Ten years later, he won that bet by a decent margin. He goes on to say -

“When dumb money knows its limitations, it ceases to be dumb.”

“Our aversion to borrowing dampened our returns. But we sleep well at night”

Buffett is not comfortable with borrowing money.

Now, you might wonder, ‘Warren Buffett is a billionaire; why would he need debt?’

Well, he’s not talking about borrowing for personal expenses. Not about buying a car or a house. (On a sidenote, Buffett has been living in a simple, modest home for more than six decades now)

Buffett buys businesses. For him, borrowing means making more investments, which means higher profits. But he dealt with debt very cautiously.

"Whenever a really bright person who has a lot of money goes broke, it's because of leverage (debt)... It's almost impossible to go broke without borrowed money being in the equation."

"Even if your borrowings are small and your positions aren't immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary. And an unsettled mind will not make good decisions."

“Charlie and I have no interest in any activity that could pose the slightest threat to Berkshire’s well-being. Starting over is not on our bucket list.”

Borrowing beyond your means may sound like a simple mistake, but it doesn’t take long for it to spiral out of control.

“There’s been far, far, far more money made by people in Wall Street through salesmanship abilities than through investment abilities.”

Over the years, Buffett has repeatedly said that for most investors, putting money into a low-cost index fund is often the smartest, simplest choice.

But instead, many fall for flashy, complicated products or trend-following schemes, usually at the nudge of commission-taking middlemen.

In his 2016 letter, Buffett took a jab at this very behaviour, saying:

“When a person with money meets a person with experience, the one with experience ends up with the money, and the one with the money leaves with experience.”

So, the next time you’re pitched a new investment product that claims to deliver superior returns, pause.

Pause to think. Pause to research. Pause to ask: Who actually benefits when I invest?

There’s another Buffett quote that I often think of. On the mis-selling of high-risk junk bonds to ordinary investors, he said-

“It is sold by someone who doesn’t care to someone who doesn’t think.”

Let’s make sure we’re not on either end of that deal.

While there are countless timeless lessons to learn from Buffett, we’ve picked our favourite four. If you’ve been following his letters, we’d love to know which ones have stayed with you the most.

What did Buffett mean when he said put money in a simple, low-cost S&P 500 index fund?

“If you don’t want to spend your life reading financial news or picking stocks, just do this one thing - put your money in an S&P 500 index fund, and let it grow.”

Now, what does that mean?

S&P 500 index fund = A basket of the 500 biggest, strongest companies in the U.S. (like Apple, Google, Coca-Cola, etc.). When you invest in it, you're putting tiny bits of money into all 500 companies at once.

Low-cost = It doesn’t charge you big fees. You keep more of your money.

Simple = No need to check stock prices daily. No stress. Just invest and chill.

Buffett believes that this “lazy” way of investing often beats most “smart” investors who try to time the market or pick the next big stock.

In short, don’t try to be a hero. Just be consistent, patient, and boring. And boring often wins.

Is this yet another trigger for gold to go up?

We Indians love to hoard gold. Whether it's for a wedding that's 10 years away or for one's education and just like us, some countries are hoarding gold for emergencies too. India's gold reserve has grown from 26000 tonnes to 32000 tonnes in 15 years. This is understandable given rising global uncertainties, especially in the last 3-4 years. We looked at how the 10 central banks with the largest gold reserves behaved over these 15 years.

Over half of all gold additions were made by four of the top 10 members: China, Japan, Russia, and India. Interestingly, though, the four largest holders of gold barely saw any addition in 15 years. Despite all the gold additions by India, the US's gold reserves are almost 10 times the size of India's.

In the wake of the escalating tensions between India and Pakistan, gold’s run in the spotlight could continue further.

This newsletter has been put together by Satya Sontanam, Apurva Gururaj, and Vineet Rajani. If you have any feedback for us or something you’d like us to cover in the upcoming newsletters, do let us know. Mail us at varsity@zerodha.com

Very useful tips from the legend. Thank you.

Very good Article Explaining of compounding of investment in life .